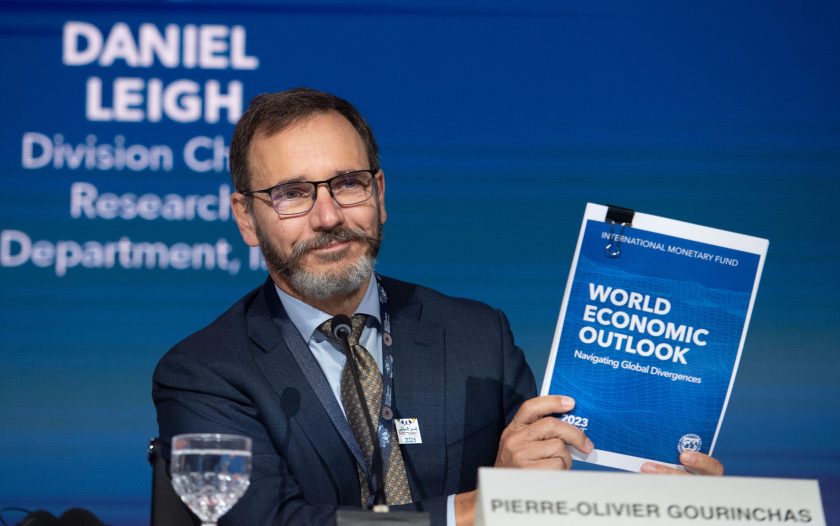

IMF Economic Advisor and Research Director Pierre-Olivier Grinchat speaks at the International Monetary Fund (IMF) conference in Marrakech, Morocco, October 10, 2023.Adem Muhammed—Anadolu/Getty Images

The International Monetary Fund has raised its outlook for the global economy this year, assuming solid growth led by the United States and a slowing pace of inflation.

Global economic growth will be 3.1% this year, unchanged from 2023 but up from the 2.9% expected in 2024 in its previous forecast in October, lenders from 190 countries said in their latest forecasts on Tuesday. is expected to exceed.

Globally, the IMF expects inflation to fall from 6.8% in 2023 to 5.8% in 2024 and 4.4% in 2025. The IMF expects inflation in developed countries to fall to 2.6% this year and 2% next year. The Federal Reserve and several other central banks have set targets.

The combination of stable growth and falling inflation has raised hopes for a so-called soft landing for the global economy, a slowdown sufficient to contain inflation without triggering a recession.

“We are now on the final downhill slope towards a soft landing,” Pierre-Olivier Grinchat, the IMF's chief economist, told reporters ahead of the report's release.

The projected global growth rate for this year and next (3.2%) is lower than the 2000-2019 average of 3.8%. Part of the reason is that the Fed and other central banks have aggressively raised interest rates to combat high inflation, resulting in higher borrowing costs. Spending and investment slowed.

Grinchas said he expected economic damage from attacks on ships in the Red Sea by Yemen-based Houthi rebels to be “relatively limited.” The attack forced container ships carrying cargo between Asia and Europe to avoid the Suez Canal and instead take a detour around the tip of Africa, resulting in delays, disruption and higher freight costs. But Grinchas said the Red Sea disruption did not appear to be “the main cause of the resurgence of supply-side inflation” at this point. Inflation resulted from much more severe vessel backlogs in 2021 and 2022.

The IMF has significantly raised its growth forecast for the United States, the world's largest economy, to 2.1% this year from 1.5%, set three months ago. The US economy expanded by 2.5% in 2023 after unexpectedly strong growth at the end of the year, driven by consumers willing to spend despite higher borrowing costs.

The outlook for China's sluggish economy was also raised by the IMF. The report currently forecasts the world's second-largest economy to grow at 4.6% this year, an increase from the 4.2% forecast in October, but a downward revision from the 5.2% growth in 2023. I expect it to be. Government spending has helped offset the damage from China's housing market collapse. .

“There has been a lot of resilience in many parts of the world,” Grinchas said, citing Brazil, India, Southeast Asia and Russia, which has remained surprisingly resilient despite Western sanctions imposed after the invasion of Ukraine. He said.

However, the IMF has revised down its outlook for some regions. Europe, for example, continues to suffer from consumer disappointment and a prolonged energy price shock caused by Russia's invasion of Ukraine. The IMF expects the 20 countries that share the euro currency to grow by just 0.9% this year. This is up from 0.5% growth in 2023, but lower than the 1.2% euro zone growth this year predicted by the IMF in October.

The IMF also revised its forecast for Japan's economy slightly downward to 0.9% growth from 1.9% growth in 2023.

The improvement in the inflation outlook is the result of higher interest rates, the clearing of supply chain hold-ups of the past few years, the entry of workers into the job market, and the fall in energy prices after the spike caused by the Ukraine war. The IMF expects oil prices, which fell 16% in 2023, to fall a further 2.3% this year and 4.8% in 2025.

The global economy continues to face risks. One is that financial markets are too confident that the Fed will reverse course and begin lowering rates as early as its March meeting. Grinchas said he expected interest rate cuts to begin in the second half of 2024. If interest rates don't come down as quickly as expected, disappointed investors could cause stock prices to fall.

Another is that geopolitical tensions, particularly between the United States and China, could disrupt global trade. Grinchas suggested that some of President Joe Biden's economic policies, including those that benefit U.S. producers of computer chips and environmental technology, could violate World Trade Organization rules.

The IMF expects global trade to grow by just 3.3% this year and 3.6% in 2025, below the historical average of 4.9%.