Fast-food companies like McDonald's (NYSE:MCD) and Yum Brands (NYSE:YUM) have been under pressure lately. While the big fast-food brands have a lot of pricing power, it's fair to say that some chains are overestimating it. When it comes to McDonald's, or Yum Brands' KFC, Taco Bell, and Pizza Hut, consumers have come to expect cheap meals. With summer coming up, McDonald's and Yum are poised to offer better value that could bring back consumers and restore momentum to their stock prices.

Aside from the delicious flavors, secret sauces, and family recipes (Colonel's spice blends remain nearly unmatched, in my opinion), the main reasons people choose to go to fast food chains are affordability and convenience. All things considered, I am bullish on MCD and YUM stocks and see the recent slump as a great buying opportunity.

McDonald's: A great shopping opportunity at the Golden Arches

McDonald's is arguably one of the most efficiently run restaurant chains in the industry, and it's using technology (such as improved delivery tracking within its loyalty app) to become even more efficient, while also experimenting with new “real estate-light” store concepts like CosMc and takeout-focused restaurants.

McDonald's may have an edge over its rivals thanks to the introduction of high-speed, two-lane drive-thrus in some of its modernized locations and the adoption of technology-driven optimizations at the store level, advancements that are helping to remove friction from the ordering experience.

With these clear upsides, I believe MCD stock is worth buying on the dip, even if temporary inflationary headwinds chip away at same-store sales growth, slowing to 1.9% in Q1 2024 from 3.4% last quarter.

Plus, with a plethora of restaurants drawing large numbers of customers, many of whom come for the discounts on their meals but stay for dessert and a McCafe drink, it's hard to find a more convenient alternative than hitting the drive-thru at your local McDonald's or ordering McDelivery. But despite the convenience factor, consumers don't seem as willing to tolerate price hikes as the company initially thought. At least, that's what the latest quarter told us.

After watching the quarter get squeezed by so many budget-minded customers, I'm starting to think value might be just as important as convenience. A limited-time offer of $5 meal bundles this summer seems like McDonald's firing off the first shot at the beginning of fast-food deflation.

Did some fast-food companies raise prices too quickly, like McDonald's did last year? Apparently so. Now that companies are looking to lower prices, value could take the lead heading into the summer.

The story continues

It's a good time to be a fast-food fan. But time will tell if summer deals will save struggling fast-food stocks. My guess is that these bargain promotions will bring back customers, but whether they'll stick around after the sales are over is another matter entirely. There's always the chance that we'll get more used to today's high prices — assuming, of course, that deflation doesn't continue beyond 2025.

The current price-to-earnings ratio of 22.7x is about 30% lower than the 31.2x for the fiscal year ending June 2023, but the current price-to-earnings ratio is attractive, as is the new value menu. The 2.5% dividend yield is also an attractive factor.

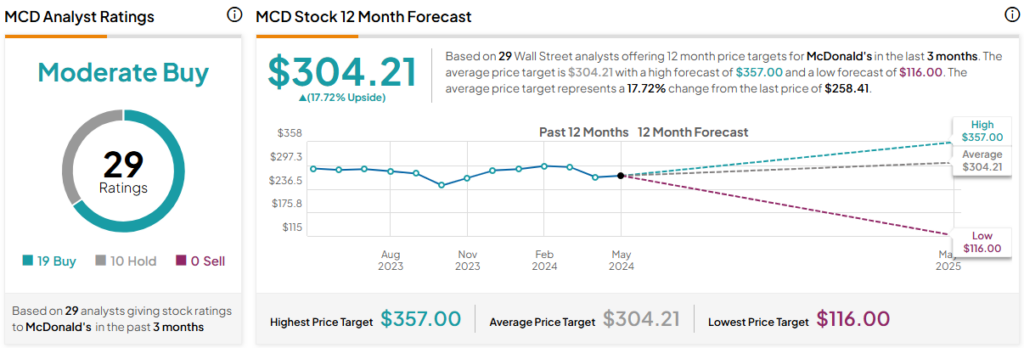

What is your price target for MCD stock?

MCD stock is rated a Moderate Buy by analysts, with 19 Buy and 10 Hold designations over the past three months. The average target price for MCD stock is $304.21, indicating an upside potential of 17.7%.

Yum! Brand: Menu Innovation and Value

Recently, Yum Brands' KFC also jumped on the popular summer discount craze with its “Taste of KFC Deals,” which offers two pieces of chicken, mashed potatoes with gravy, and a biscuit starting at $4.99. Wendy's (NYSE:WEN) also unveiled a $3 breakfast meal, which seems like a direct response to McDonald's latest deals.

Indeed, value appears to be the deciding factor for fast-food companies as they try to outdo each other while attracting budget-conscious customers.

Unlike MCD stock, which is in correction territory, YUM stock is about 3% away from new highs. After a weak recent quarter, the Yum! brand could drive growth with a combination of menu innovation and value menu items.

In the most recent quarter, sales declined in some segments, with KFC's sales in the US falling 2%, with the majority of that coming from the US market (comparable sales were down 8%). Americans are certainly feeling the pain of inflation, but with new value menu deals in place, it's unlikely to last for long.

Among fast-food chains, Yum! deserves top marks for menu innovation; KFC's Double Down sandwich is a strong contender in the chicken sandwich wars; and Pizza Hut's Melt might be enough to draw hungry customers.

Either way, YUM's stock looks incredibly cheap, trading at a record price-to-earnings ratio of 24.7, well below the 32.5x multiple for the fiscal year ending June 2023. Inflation headwinds won't last forever, and that will change once menu innovation and value menus start to impact future quarters.

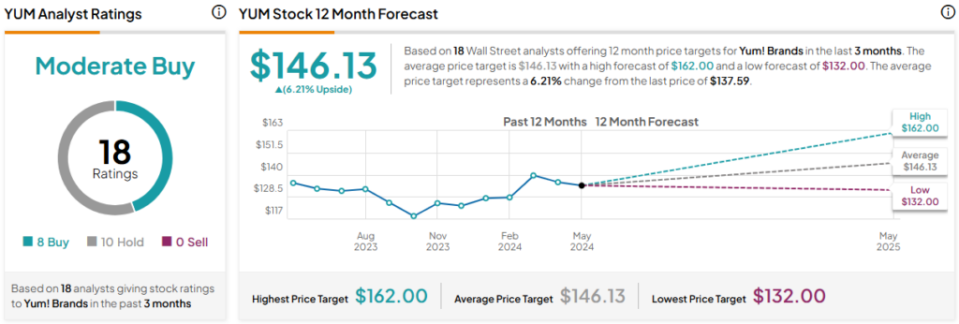

What is your price target for YUM stock?

Analysts have rated YUM stock as a Moderate Buy, with 8 Buy and 10 Hold designations over the past three months. The average target price for YUM stock is $146.13, indicating an upside potential of 6.2%.

Conclusion

Fast-food chains can't stay stagnant forever. Value menu items may bring back foot traffic in the summer, but McDonald's and Yum will need to work harder to keep customers coming. Perhaps menu innovation and a more cautious approach to future price increases will be key to not alienate consumers again. Overall, analysts are bullish on both stocks, but of the two, they expect MCD stock to rise more.

Disclosure