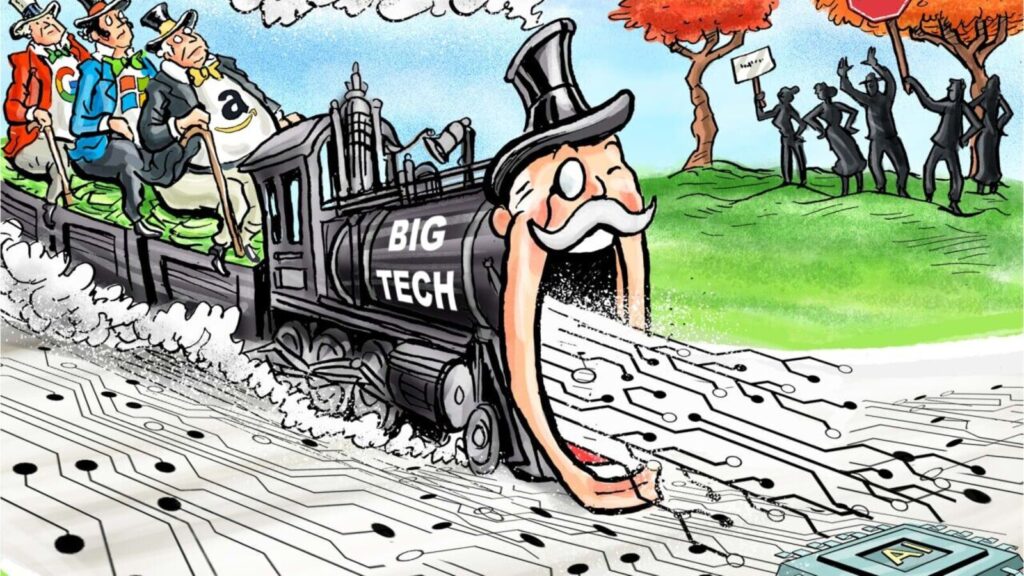

Microsoft, Google and Amazon are phenomenally successful companies, with an unparalleled ability to stifle competition in their primary and adjacent markets. These tech giants are now seeking to dominate artificial intelligence technologies. If allowed to dominate AI, they could consolidate and extend their dominance in broader areas of the economy. It is essential that competition authorities closely monitor, and where necessary crack down on, the investments and partnerships Big Tech are making to increase their control over AI.

Microsoft, Google and Amazon are phenomenally successful companies, with an unparalleled ability to stifle competition in their primary and adjacent markets. These tech giants are now seeking to dominate artificial intelligence technologies. If allowed to dominate AI, they could consolidate and extend their dominance in broader areas of the economy. It is essential that competition authorities closely monitor, and if necessary, crack down on, the investments and partnerships Big Tech is making to increase its control over AI.

Big Tech's strategy for expanding their dominance is well known: Once these platforms have established monopoly or near-monopoly power in a major market, they move into adjacent markets to gain a competitive advantage. According to a report by the House Judiciary Antitrust Subcommittee, Big Tech companies have frequently “invested in” startups and technologies in adjacent markets, integrated or bundled these products into their dominant platforms, and then given their products an advantage by providing superior access to their platforms.

Hello! You're reading a premium article! Subscribe now to continue reading. Subscribe now Already a subscriber? Log in

Premium Benefits

35+ Premium Articles Every Day

Specially curated newsletters every day

Access 15+ print articles every day

Exclusive webinars with expert journalists

Select e-papers, archives, and articles from The Wall Street Journal and The Economist

Access to subscriber-only specials: infographics and podcasts

35+ Well-Researched Unlocks

Daily Premium Articles

Access to global insights

Over 100 exclusive articles

International Publications

Exclusive newsletter for 5+ subscribers

Specially curated by experts

Free access to e-paper and

WhatsApp updates

Big Tech's strategy for expanding their dominance is well known: Once these platforms have established monopoly or near-monopoly power in a major market, they move into adjacent markets to gain a competitive advantage. According to a report by the House Judiciary Antitrust Subcommittee, Big Tech companies have frequently “invested in” startups and technologies in adjacent markets, integrated or bundled these products into their dominant platforms, and then given their products an advantage by providing superior access to their platforms.

Big tech companies can thus stay ahead of the normal evolution of emerging markets: adjacent markets become mere satellites of the dominant company rather than evolving into their own solar systems. This not only allows the tech giants to absorb new territory, but also prevents the emergence of new rivals with technologies that could disrupt their platform's dominance.

This strategy is deliberate: internal discussions at leading companies often indicate that the primary reason for investing in adjacent technologies is to thwart threats to the company's core platforms and turn them instead into “improvements” that can protect the company from competitive challenges.

The latest threat big tech companies pose to their competitors concerns AI. The potential of AI, for better or worse, remains to be seen. But we know enough to warrant scrutiny of investments and partnerships with AI startups by big platform companies.

Microsoft already has a partnership with OpenAI that includes billions of dollars in investment, collaboration on technology development, and exclusive access to Microsoft cloud services for OpenAI. This collaboration with a dominant company like Microsoft has a strong history of stifling competition in important emerging technologies that could otherwise grow and compete with top market players. Incorporating OpenAI capabilities into the Microsoft platform will undoubtedly strengthen the platform's advantage.

Another concern is that AI could fall into the wrong hands. Some policymakers have raised legitimate national security concerns about the dominance of these large platforms in AI. Companies are subject to some degree of influence and pressure from Communist China as a condition of doing business there.

The arrangement would likely include granting Beijing and other foreign governments access to technology and code. As a Microsoft spokesperson put it, the company “has given governments around the world permission to inspect parts of our source code for many years.” Microsoft has significant ties to China's AI development through its funding of Microsoft Research Asia, which was founded in 1998. Such collaborations carry increased risks of hacking and technology theft. Other large platforms are under similar pressure, raising the risk of theft and hacking.

One of the reasons the big tech companies have become so powerful is that over the past 25 years, regulators have been lax, allowing the big tech companies to gobble up new companies before they could pose a competitive threat. We cannot afford to repeat that mistake. We need to carefully scrutinize investments by dominant platforms up front, lest governments try to undo the damage when it's not feasible.

Fortunately, we appear to be learning from our mistakes, and it is encouraging that the Federal Trade Commission, the European Union, and the UK Competition and Markets Authority have each launched investigations to assess issues arising from big tech companies’ investments in AI.

In January, the FTC, acting under its authority under Section 6(b) of the FTC Act, ordered Alphabet/Google, Microsoft, Amazon, Anthropic PBC, and Open AI to review Big Tech's “corporate partnerships and investments with AI providers to better understand these relationships and their impact on the competitive environment.”

The European Commission is “investigating some of the agreements concluded between large digital market players and generative AI developers and providers,” specifically considering whether Microsoft's investment in OpenAI is subject to review under the EU Merger Regulation. In April, the UK Competition and Markets Authority sought stakeholder views on Microsoft and Amazon's AI investments. It also revealed that it had found an “interconnected web” of more than 90 partnerships and “strategic investments” between the same group of companies that could be used to “protect themselves against competition.”

These are important, proactive and balanced actions. Some of these investments may be justified, but in any event regulators must address their potential anticompetitive effects up front. And relevant market participants should not sit idly by while these and other investigations proceed.

Barr is co-founder of the Torridon Law Firm, a Hudson Institute Distinguished Fellow, and author of the memoir “One Damn Thing After Another.” He served as Attorney General of the United States from 1991 to 1993 and from 2019 to 2020.

Topics that might interest you Check out all the Business News, Market News, Latest News Events and Breaking News on Live Mint Download the Mint News App to get daily market news.

Source link