With global markets experiencing mixed conditions, with China's Shanghai Composite Index and CSI 300 experiencing notable declines amid ongoing economic pressures, investors are closely monitoring changing market trends. In these circumstances, researching growing companies with high insider ownership, such as Guangzhou Goaland Energy Conservation Tech, can provide valuable insights into a company with potentially resilient and informed strategic direction.

Top 10 growing companies with high insider ownership in China

name

Insider Ownership

Revenue Growth

Kevoda Technology (SHSE:603786)

12.8%

25.1%

Suzhou Sanmun Technology Co., Ltd. (SZSE:300522)

37.6%

63.4%

Zhejiang Songyuan Automotive Safety System Co., Ltd. (SZSE:300893)

20%

24.2%

Arctec Solar Holdings (SHSE:688408)

38.7%

24.5%

Sinen Electric Limited (SZSE:300827)

36.5%

39.8%

Anhui Huaheng Biotechnology Co., Ltd. (SHSE:688639)

31.5%

28.4%

UTour Group (SZSE:002707)

twenty four%

33.1%

Xi'an Sinofuse Electric (SZSE:301031)

36.8%

43.1%

Jilin University Zhengyuan Information Technology (SZSE:003029)

12.1%

58.6%

Ofun Educational Technology (SZSE:002607)

26.1%

65.3%

To see the full list of 408 stocks from our Fast Growing China Companies with High Insider Ownership screener click here.

Let's select some of the screener results and explore them.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Goldland Energy Saving Technology specializes in energy saving technology and has a market capitalization of approximately 4.03 billion yuan.

Business Description: Our company operates primarily in the field of energy-saving technology.

Insider Ownership: 15.5%

Revenue growth forecast: 28.0% per year

Guangzhou Goalland Energy Conservation Tech is expected to see strong growth, with profits expected to surge 72.25% per year. Although a three-year return on equity is forecast to be lower at 5.7%, the company's 28% annual revenue growth is above the Chinese market average of 14%. A recent financial report suggests improved profitability, with the company turning from a net loss to a net profit of RMB 5.62 million in the first quarter of 2024. However, investors should be cautious as the share price has been very volatile over the past three months.

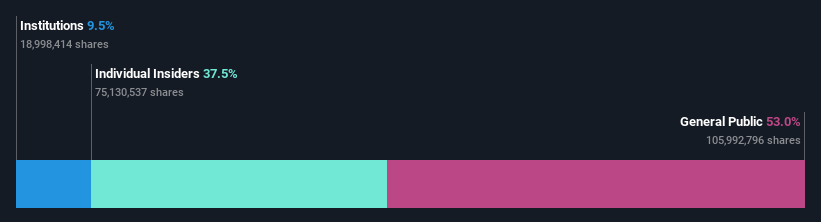

SZSE:300499 Ownership breakdown as of May 2024

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Guangshun Photosensitive New Materials Co., Ltd. operates in the photosensitive materials sector and has a market capitalization of approximately RMB 3.39 billion.

The story continues

Business Description: The Company derives revenue from its business in the photosensitive materials sector.

Insider Ownership: 37.5%

Revenue growth forecast: 41.2% annualized

Jiangsu Guangshun Photosensitive New Materials Co., Ltd. is showing promising growth, with profits and sales forecast to grow 83.9% and 41.2% annually, respectively, significantly outperforming the CN market average. Having recently turned profitable, the company reported a significant increase in sales from RMB497.87 million last year to RMB509.94 million in 2023, and a reversal of its net loss to a net profit of RMB6.9 million. However, financial results have been affected by significant one-time items, and shareholder dilution over the past year has raised concerns about a decline in share value.

SZSE:300537 Ownership breakdown as of May 2024

Simply Wall St Growth Rating: ★★★★★☆

About Qingdao Guolin Science and Technology Group Co., Ltd. is a company specializing in environmental technology solutions with a market capitalization of approximately RMB 2.53 billion.

Business: The text provided does not specify the company's revenue segments.

Insider Ownership: 29.7%

Revenue growth forecast: 60.1% annualized

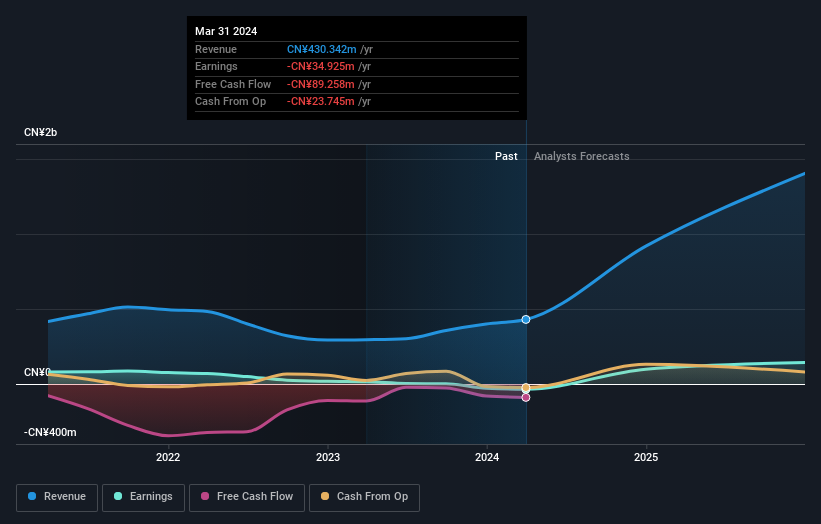

Qingdao Guolin Science and Technology Group Co., Ltd. recently completed a share buyback, buying back RMB 30.17 million worth of shares. This demonstrates management's confidence, despite reporting a net loss of RMB 29.14 million for the full year ending December 31, 2023. The company's revenue is expected to grow 60.1% annually over the next few years, significantly outpacing the growth rate of the Chinese market. However, this growth has come amid significant share price volatility and a recent swing from net profit to net loss, highlighting potential risks along with its aggressive growth strategy.

SZSE:300786 Revenue and sales growth as of May 2024

Turning ideas into action

Looking for other investments?

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. This is not a recommendation to buy or sell stocks, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned. This analysis only considers shares directly held by insiders. It does not include shares indirectly held through other means such as corporations or trust companies. All forecast revenue and profit growth rates quoted are expressed as 1-3 year annualized growth rates.

Companies featured in this article include SZSE:300499, SZSE:300537, SZSE:300786.

Have something to say about this article? If you have any questions about the content, please contact us directly or email us at editorial-team@simplywallst.com.