Technology stocks have been driving the market higher in recent years, driven by powerful trends such as artificial intelligence (AI). Let's take a look at three of these tech stocks and why they may be good choices to buy and hold for the long term.

1. NVIDIA

No company has benefited more from AI than chipmaker Nvidia (NASDAQ: NVDA), and there's every reason to believe the company and its shareholders will continue to benefit from current AI trends.

Nvidia's graphic processing units (GPUs) power the AI training and inference needed to power AI applications. While the company isn't the only GPU maker, its chips have become the industry standard because programmers are generally trained using its CUDA software platform. This gives the company a wide berth, as getting programmers to learn other platforms would be time-consuming and costly.

Image source: Getty Images

AI is still in its early stages, and Nvidia is well positioned to continue riding the wave as demand for its chips soars. The company has seen big demand from data center customers, but the technology is likely to spread to other areas, such as automobiles. Tesla CEO Elon Musk has suggested that given the amount of computing power put into his company's vehicles, they could be used as distributed computing networks.

On top of that, the company is rapidly innovating, unveiling new and improved GPU architecture designs such as the recently announced Blackwell, and has already unveiled its next-generation GPU architecture, Rubin, due next year.

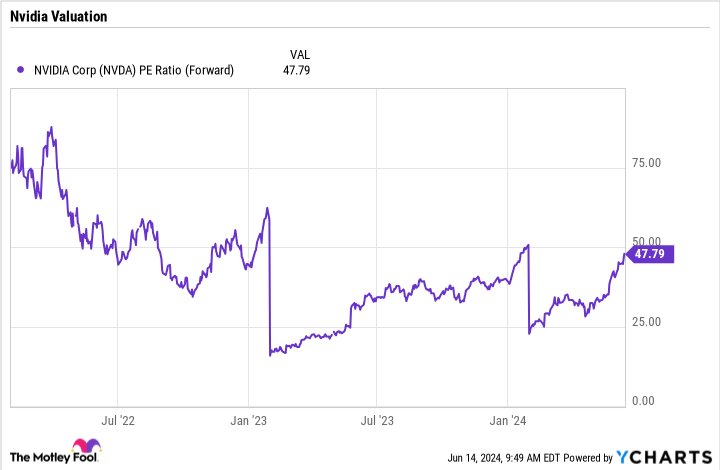

The stock is trading at a forward price-to-earnings (P/E) ratio of about 48 times, making it a great stock to buy and hold for the long term, as it looks undervalued given its current growth and future prospects.

NVDA Price/Earnings (Forward) Chart

2. Taiwan Semiconductor Manufacturing

Another company that looks set to jump on the AI chip bandwagon is Taiwan Semiconductor Manufacturing Co. (NYSE: TSM), or TSMC, a major semiconductor contract manufacturer that makes chips for Nvidia and other semiconductor companies at its own foundries.

TSMC is expanding its production capacity as demand for AI chips outstrips supply. The company is expanding and building new manufacturing facilities (fabs) while driving new technological innovations, including a transition to 2-nanometer production technology. Increasing chip density allows more chips to fit on a wafer, which increases production capacity while also improving chip performance and power consumption.

The story continues

Nvidia's success has led to a growing number of companies, from traditional rivals like Advanced Micro Devices to cloud computing companies like Amazon and Alphabet, developing their own AI chips to grab a share of this huge market. As chipmakers scramble to secure limited production capacity, TSMC is in an advantageous position because it has superior pricing power. In fact, the company has signaled it will raise prices soon.

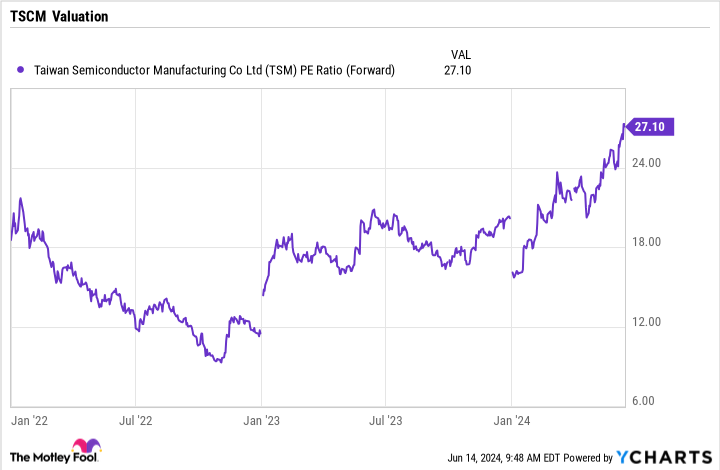

Trading at a forward price-to-earnings (P/E) ratio of 27, an attractive valuation given the long-term growth outlook, makes it a solid stock to buy and hold for the long term.

TSM PE Ratio (Forward) Chart

TSM PE Ratio (Forward) data from YCharts

3. ASML

Continuing our theme of tech stocks that will benefit from the AI chip boom, we arrive at ASML (NASDAQ: ASML), which makes the equipment that companies like TSMC use to manufacture semiconductors. As demand for AI chips increases and factories expand, more equipment will be needed to manufacture those chips.

ASML will benefit from increased demand for its semiconductor equipment and the introduction of its latest technology, high numerical aperture extreme ultraviolet lithography systems (high NA EUV). The new systems enable manufacturers to make transistors smaller and fit more transistors on a silicon wafer. ASML says its new high NA EUV technology will improve manufacturing productivity, reduce production costs and increase chip functionality.

The company plans to ship the latest systems to its three biggest customers by the end of the year. It's not cheap, costing $380 million, but it will be a big revenue driver for ASML as chipmakers seek the latest technology to produce the most chips to meet the insatiable demand for AI chips.

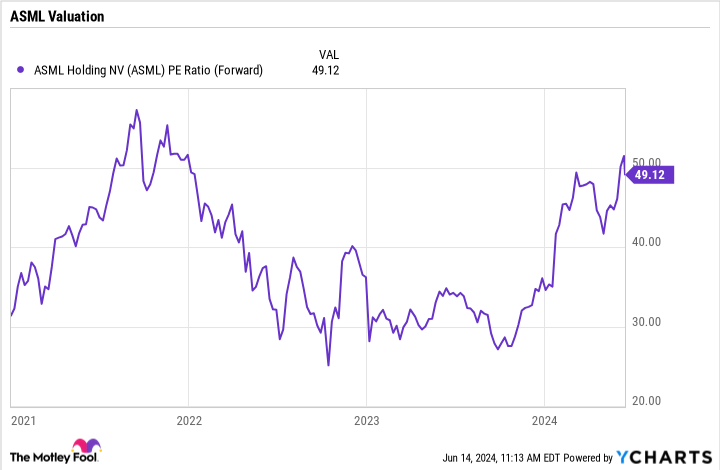

ASML Price/Earnings Ratio (Forward) Chart

ASML shares are trading at a forward price-to-earnings (P/E) ratio of about 49, but the new system is expected to help revenue and profit growth surge next year, with adjusted earnings per share (EPS) expected to rise from an estimated $20.48 this year to $31.79 in 2025. This brings the company's valuation down to an attractive forward P/E ratio of 32. Given the boom in AI chips, this is an attractive valuation and makes ASML another strong stock to buy and hold for the long term.

Should I invest $1,000 in Nvidia right now?

Before you buy Nvidia stock, consider the following:

The analyst team at Motley Fool Stock Advisor has identified 10 stocks that investors should buy right now, and Nvidia is not among them. The 10 selected stocks have the potential to generate big gains over the next few years.

Consider the date when Nvidia created this list, April 15, 2005… if you had invested $1,000 at the time of recommendation, you would have made $808,105!*

Stock Advisor gives investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts, and two new stock picks every month. The Stock Advisor service has more than quadrupled S&P 500 returns since 2002*.

View 10 stocks »

*Stock Advisor returns as of June 10, 2024

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool's board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, serves on The Motley Fool's board of directors. Jeffrey Saylor owns shares in Alphabet. The Motley Fool owns shares of and recommends ASML, Advanced Micro Devices, Alphabet, Amazon, NVIDIA, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has a disclosure policy.

The post Have $5,000 to Spend? 3 Best Tech Stocks to Hold for the Long Term appeared first on The Motley Fool.