(Bloomberg) — Asian stocks edged higher, bucking a mixed day on Wall Street, as investors worried the technology sector rally was losing steam.

Most read articles on Bloomberg

Stocks in South Korea, Australia and Japan rose. Hong Kong stock futures were trending higher and the Nasdaq Golden Dragon China Index, a gauge of U.S.-listed Chinese stocks, rose 1.3% on Monday. Various non-tech sectors rose on Monday but Nvidia continued its three-day slump of about $430 billion, crossing the technical threshold for a correction. Energy and financial stocks rose but the tech-heavy Nasdaq 100 was down more than 1%.

The 10-year Treasury yield stabilized at the open after falling 2 basis points in the previous session, while the U.S. dollar rose against most G10 currencies after falling on Monday.

“Asian stock markets will be mixed today,” IG Australia market analyst Tony Sycamore wrote in a note. “Lower US yields and a weaker US dollar will provide some support. There is also a possibility of a month-end correction in buying flows in both the Nikkei and Chinese stock markets.”

In Asia, traders are watching for signs of further pressure on China, the world's second-largest economy. Data released on Monday showed China's fiscal revenues fell at the fastest pace in more than a year, raising hopes the government may make another unusual mid-year budget revision to help the economy recover.

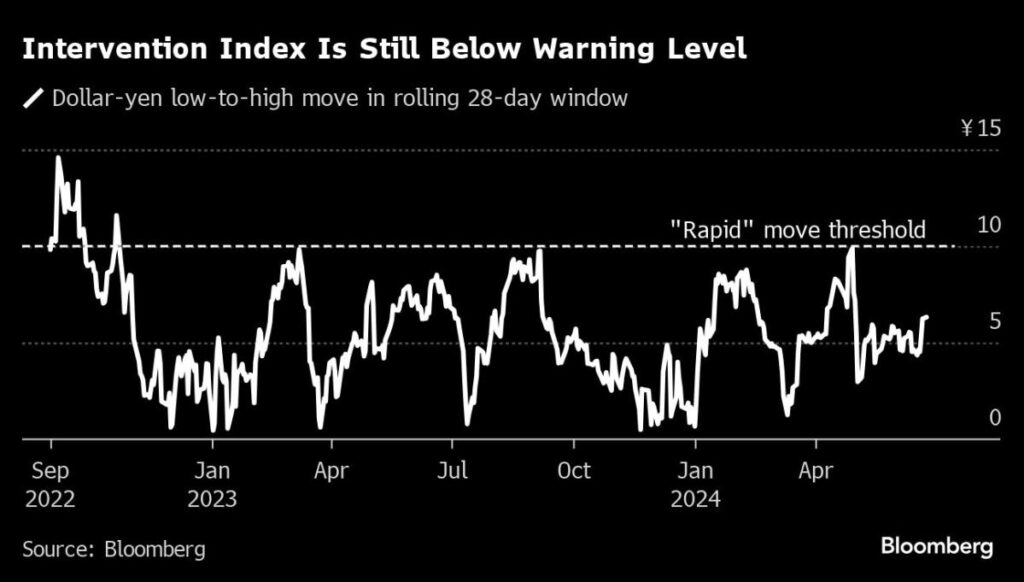

Meanwhile, Japan's top foreign exchange official warned that authorities were ready to intervene around the clock if necessary as the yen came under pressure to hit its lowest level in nearly 34 years. Some traders even see the yen falling to 170 to the dollar.

According to an average of the survey's 586 respondents, the S&P 500 is expected to finish the year at 5,606, less than 3% higher than current levels and indicating there is little room for growth after a 14% rally so far in 2024. Additionally, nearly half of survey participants expect a correction to begin later this year.

“We remain concerned about a near-term unwinding for many of the biggest names this year,” said Jonathan Krinsky at BTIG. “Bulls need to expect continued rotation beneath the surface if the S&P 500 is to avoid a major sell-off into July.”

The story continues

Deutsche Bank's Binky Chadha said U.S. stocks will take a breather after a rally led by tech stocks. There's a lot of good news priced into the market, and there could be downside risks if that optimism proves unfounded, said Lori Calvasina of RBC Capital Markets. Oppenheimer's John Stoltzfus said the bull market looks sustainable, but he expects some profit-taking.

“Even if the tech industry performs well over the summer, it's certainly possible that the industry could decline,” said Matt Murray of Miller Tabak. “Even if we subscribe to the most bullish scenario for the AI phenomenon in the second half of 2024, no group moves in a straight line.”

In commodity markets, crude oil prices rose, supported by a weaker dollar and rising tensions with Russia.

Bitcoin rebounded after plunging 6.6% on Monday. Losses are piling up in the cryptocurrency market after its second-biggest weekly drop of 2024, reflecting waning demand for bitcoin exchange-traded funds and uncertainty over monetary policy.

Major events this week:

U.S. Conference Board Consumer Sentiment Index, Tuesday

Federal Reserve Board Chairs Lisa Cook and Michelle Bowman to speak Tuesday

U.S. new home sales Wednesday

China industrial profits Thursday

Eurozone economic confidence, consumer confidence on Thursday

U.S. durable goods, jobless claims, GDP on Thursday

Nike reports earnings on Thursday

Japan Tokyo Consumer Price Index, unemployment rate, industrial production, Friday

US PCE Inflation, Spending and Income, University of Michigan Consumer Confidence, Friday

Fed President Thomas Barkin to speak Friday

Some of the key market developments:

stock

S&P 500 futures were little changed as of 9:21 a.m. Tokyo time.

Hang Seng futures up 0.5%

Japan's TOPIX rises 0.8%

Australia's S&P/ASX 200 rose 0.7%

Euro Stoxx 50 futures fell 0.6%

currency

The Bloomberg Dollar Spot Index was little changed.

The euro was little changed at $1.0734

The Japanese yen remained unchanged at 159.62 yen to the dollar.

The offshore yuan was little changed at 7.2838 per dollar.

Cryptocurrency

Bitcoin rose 1.5% to $60,362.26.

Ether rose 1.2% to $3,350.73.

Bonds

The yield on the 10-year Treasury note was little changed at 4.23%.

Japan's 10-year government bond yield was little changed at 0.990%

Australia's 10-year government bond yield fell 1 basis point to 4.21%.

merchandise

West Texas Intermediate crude rose 0.1% to $81.74 a barrel.

Spot gold fell 0.2% to $2,330.21 an ounce.

This story was produced with assistance from Bloomberg Automation.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP