January 24, 2021

Laura Jones, Daniele Palumbo and David Brown, BBC News

BBC

BBC

The COVID-19 pandemic has spread to almost every country around the world.

The spread of the virus is forcing economies and businesses around the world to count the costs, and governments are struggling with new lockdown measures to tackle the spread of the virus.

Despite the development of new vaccines, many are still wondering what recovery will look like.

Here are some charts and maps to help you understand the economic impact of the virus so far.

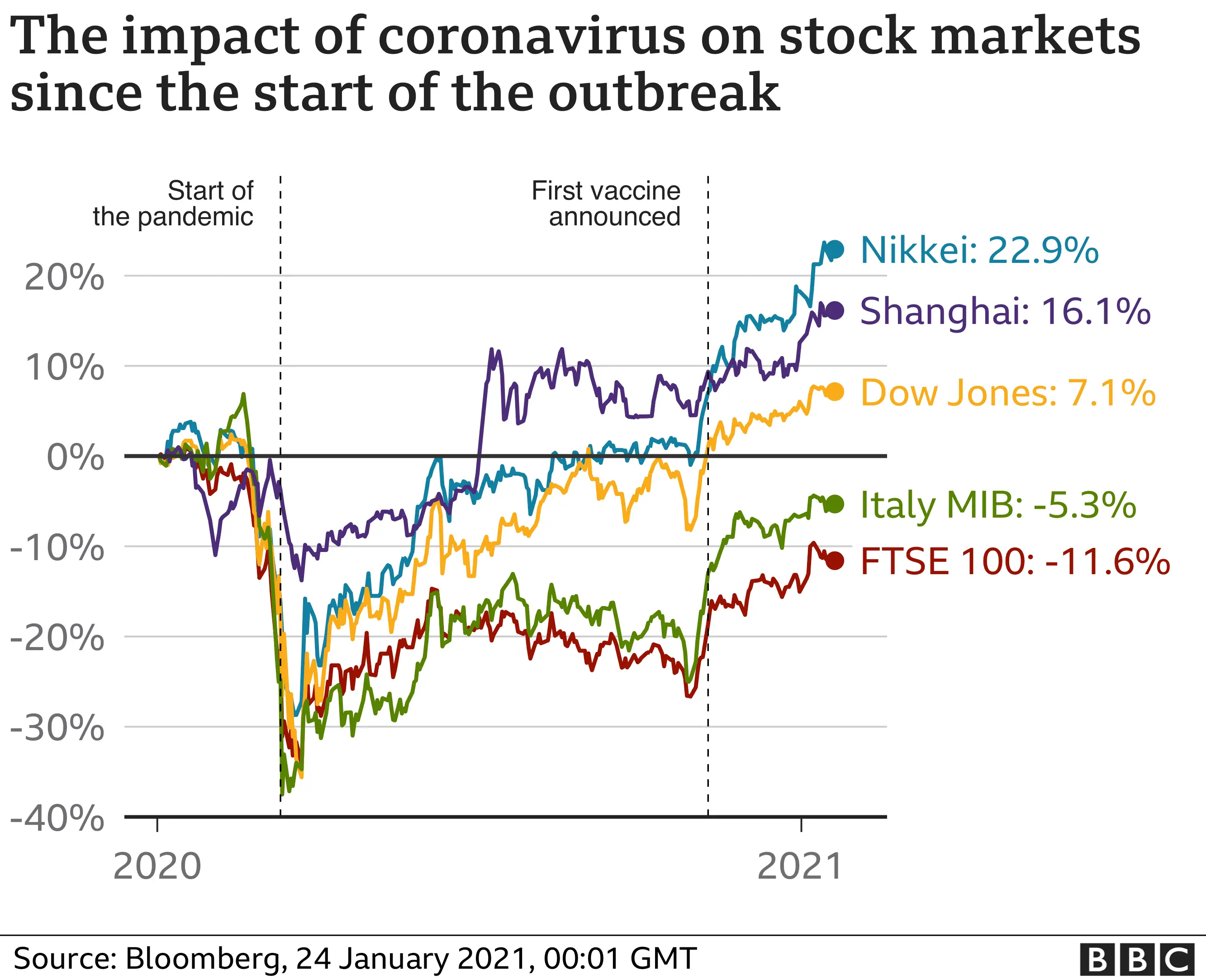

Fluctuations in global stocks

Big fluctuations in the stock market, where company shares are bought and sold, can affect the value of your pension or Individual Savings Account (ISA).

The FTSE, Dow Jones Industrial Average and Nikkei all fell sharply as COVID-19 cases rose in the first months of the crisis.

Major stock markets in Asia and the US have recovered since the first vaccines were announced in November, but the FTSE remains in negative territory.

In response, central banks in many countries, including the UK, have cut interest rates, in theory making borrowing more expensive and encouraging spending that will jump-start economies.

Some markets recovered in January this year, a normal trend known as the “January effect.”

Analysts worry that further lockdowns and delays to vaccination programs could lead to more market volatility this year.

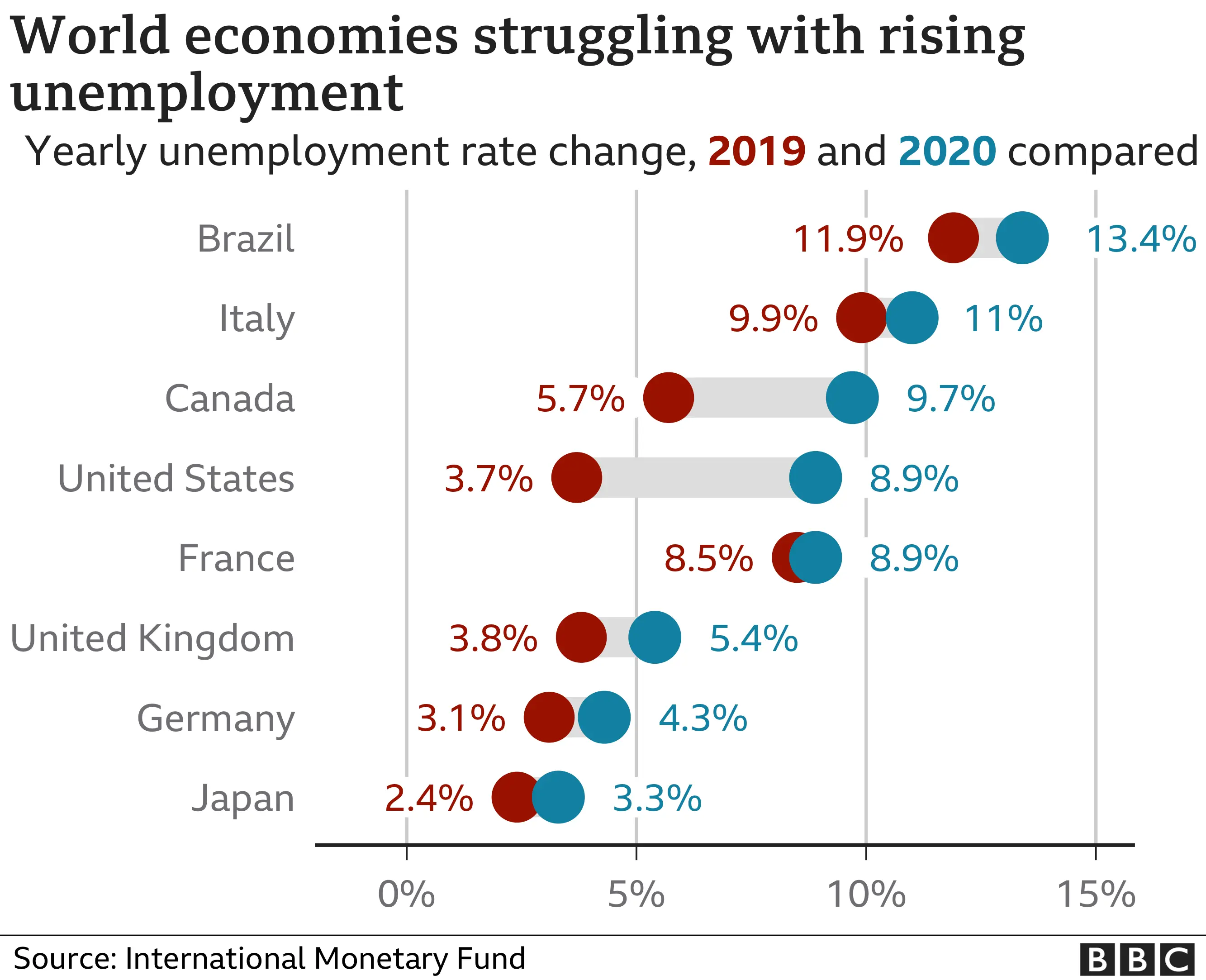

A tough year for jobseekers

Many people have lost their jobs or experienced a reduction in income.

Unemployment is rising across all major economies.

According to the International Monetary Fund, unemployment in the United States has reached a total of 8.9% for the year, signaling an end to a decade of job growth.

With parts of the economy, such as tourism and hospitality, at a near standstill, millions of workers are on government-backed job retention schemes.

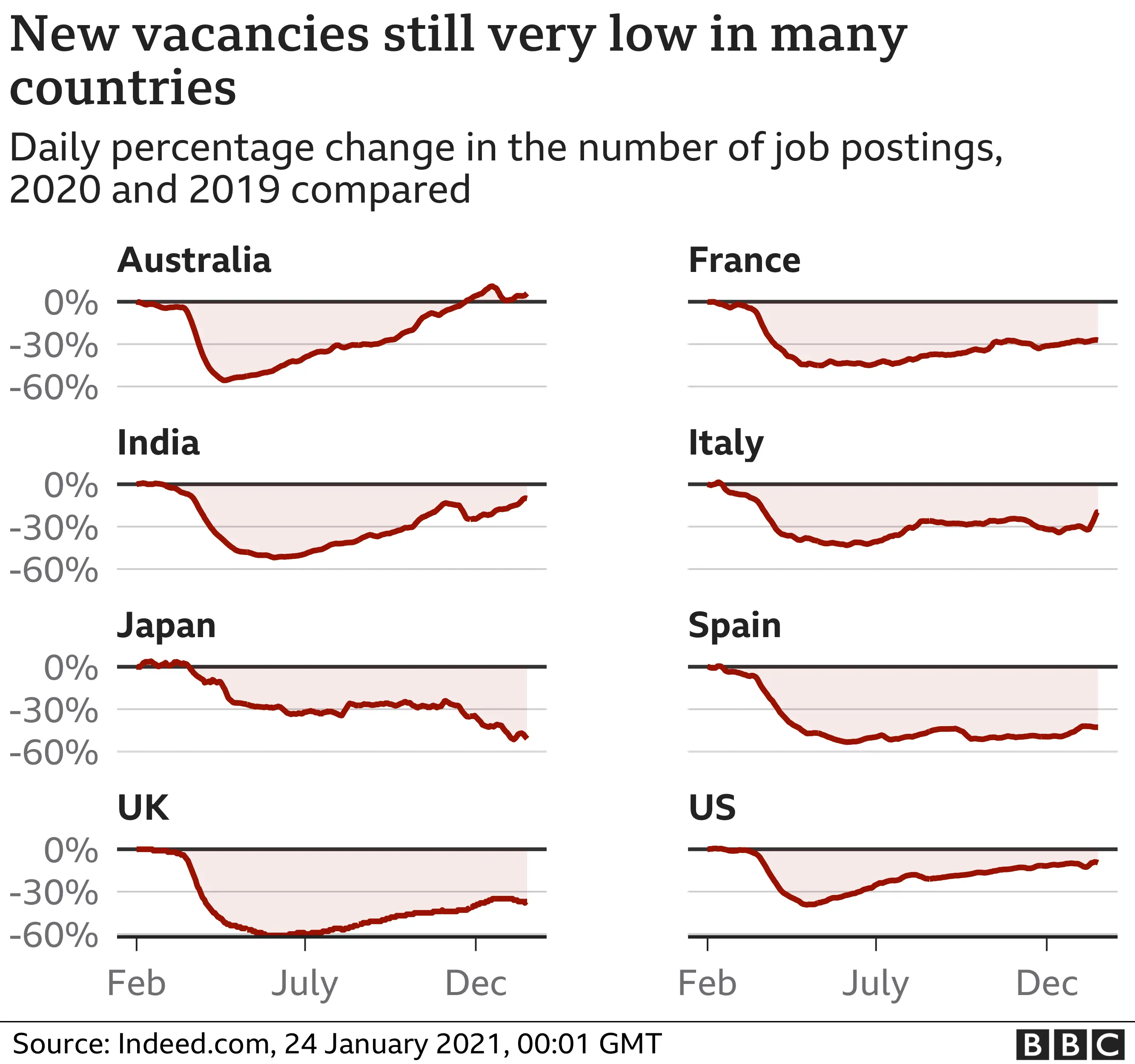

In many countries, the number of new job opportunities remains very low.

While Australia’s job vacancies have returned to the same level as 2019, France, Spain, the UK and several other countries are lagging behind.

Some experts have warned that it could take years for employment levels to return to pre-pandemic levels.

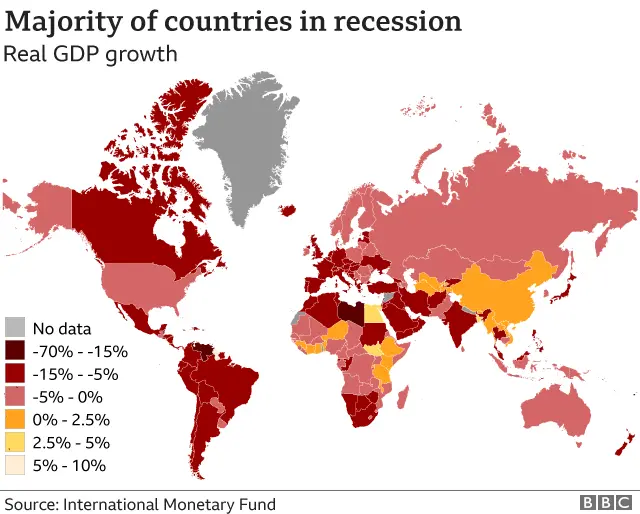

Most countries are currently in recession.

A growing economy generally means more wealth and more new jobs.

It’s usually measured by looking at the percentage change in gross domestic product — the value of goods and services produced — over a three-month or year period.

The IMF estimates that the global economy contracted by 4.4% in 2020. The organization said the decline was the worst since the Great Depression of the 1930s.

However, the IMF predicts global economic growth of 5.2% in 2021.

This will be mainly driven by countries such as India and China, which are expected to grow by 8.8% and 8.2% respectively.

Economic recovery is expected to be slow in large, service-dependent countries that have been hit hard by the outbreak, such as Britain and Italy.

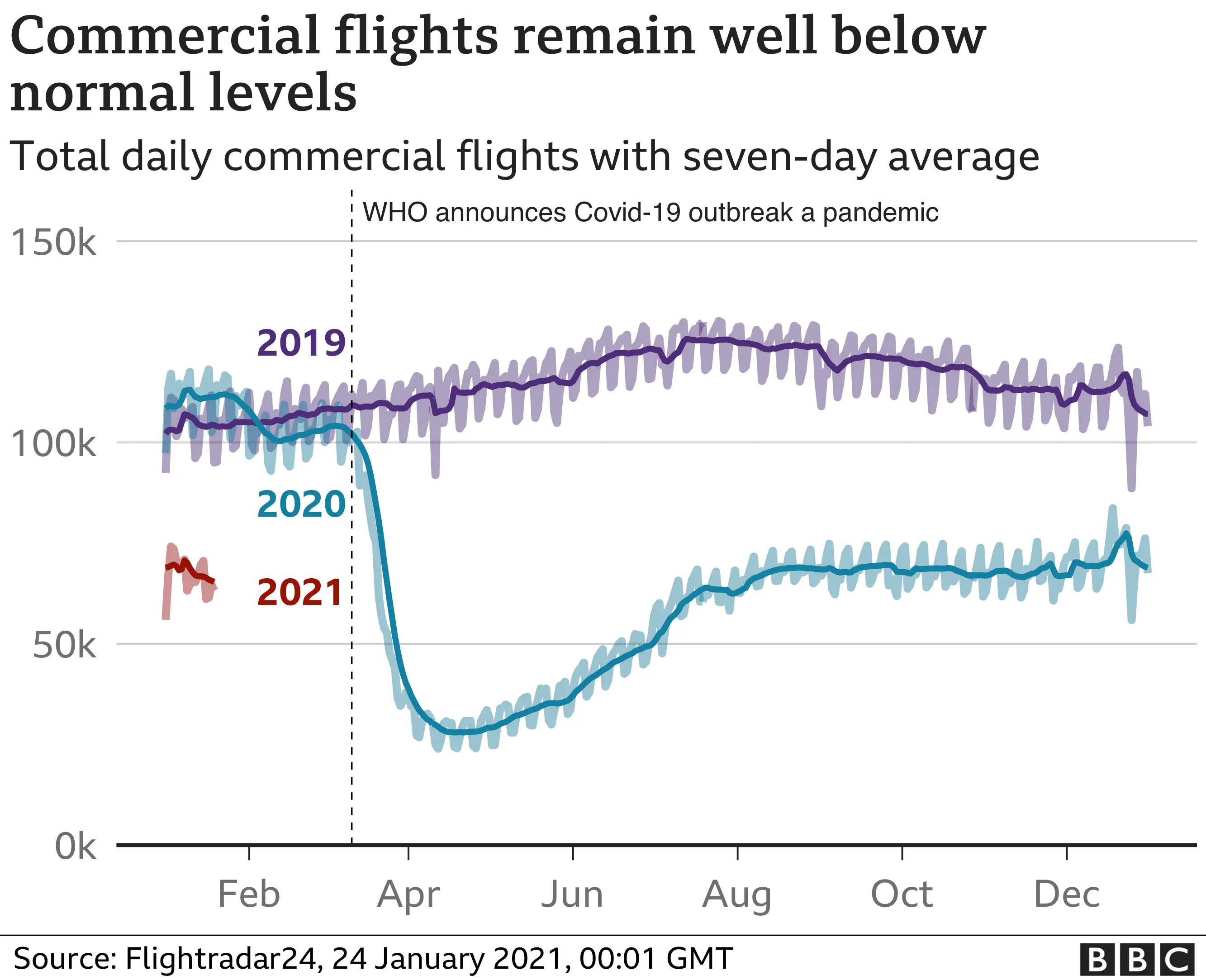

The journey is far from beginning

The travel industry has been hit hard, with airlines cutting flights and customers canceling business trips and vacations.

New variants of the virus have been discovered in recent months, forcing many countries to introduce stricter travel restrictions.

Data from flight tracking service Flight Radar24 shows that global flight numbers have taken a major hit in 2020 and are still a long way from recovering.

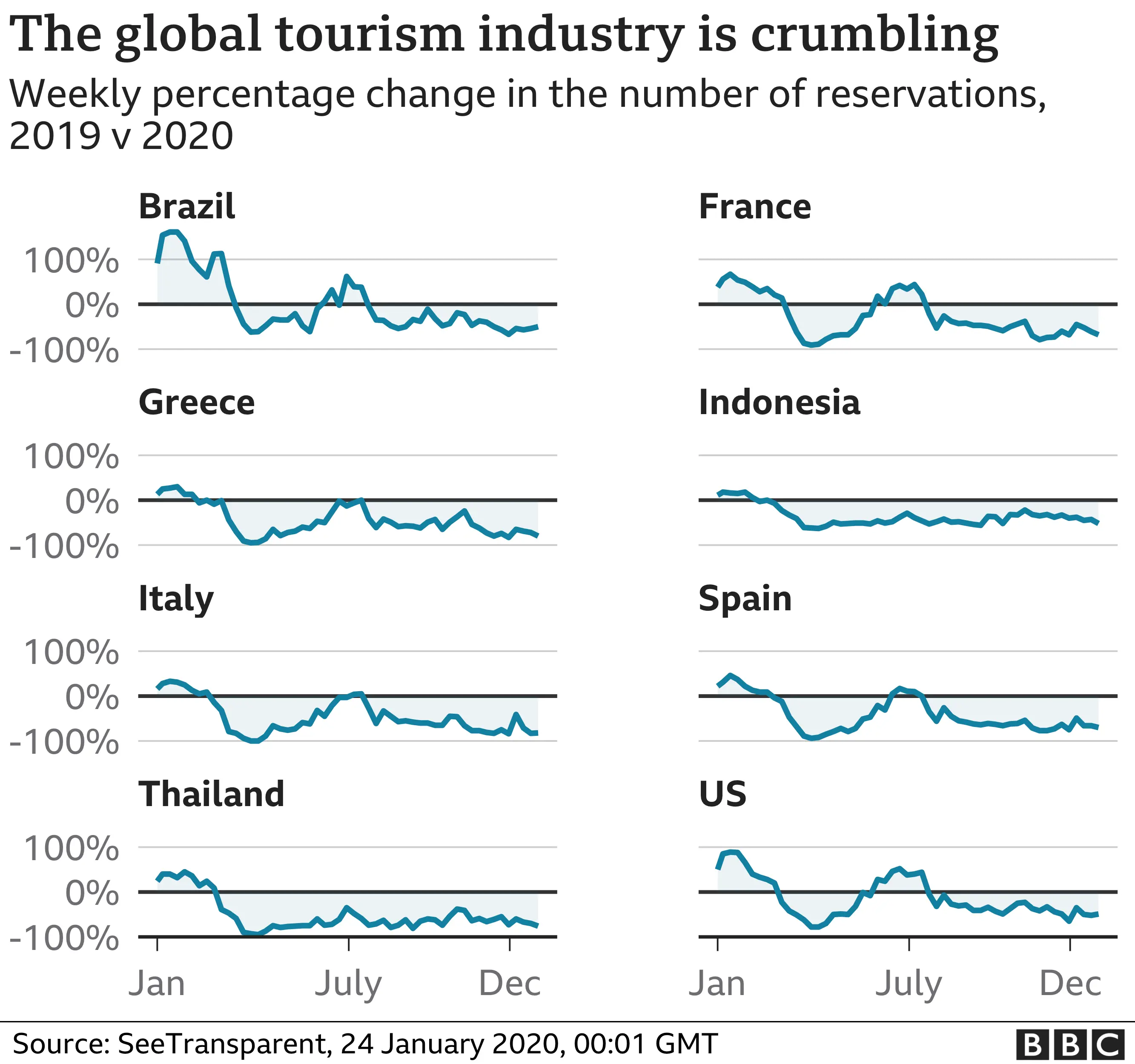

Hospitality industries shut down around the world

The hospitality industry has been hit hard, with millions of jobs lost and many businesses going bankrupt.

According to data from Transparent, a leading information company with listings for over 35 million hotels and rental properties worldwide, all major travel destinations have recorded declines in bookings.

Billions of dollars have been lost in 2020, and although projections for 2021 are improving, many analysts don’t expect international travel and tourism to return to normal pre-pandemic levels until around 2025.

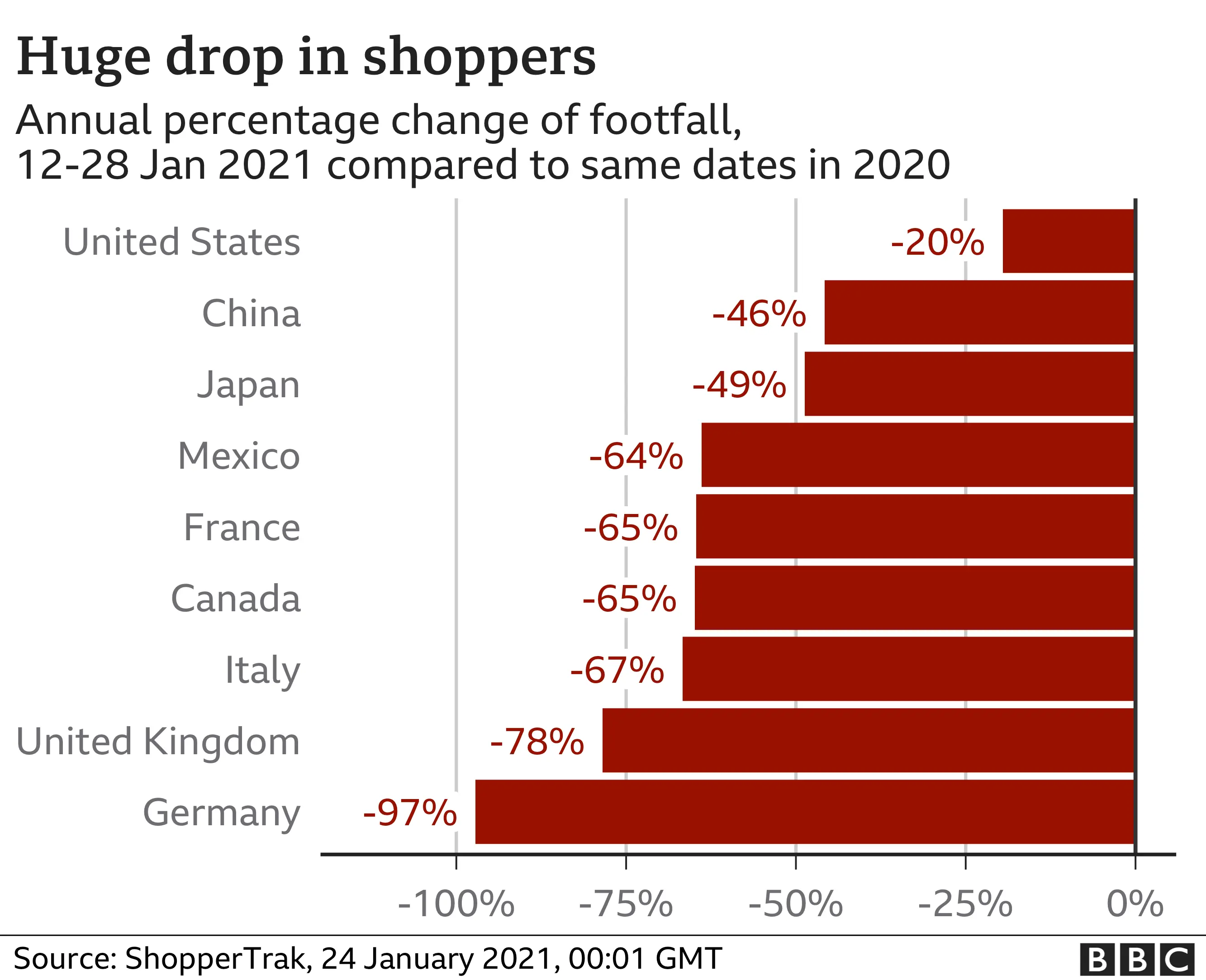

Shopping at home

Retail store traffic fell to unprecedented levels as shoppers stayed home.

New variants and a surge in cases are making the problem worse.

Pedestrian numbers have fallen further since the first lockdown, according to research firm ShopperTrak.

Another survey suggests consumers remain uneasy about returning to stores, with accountancy giant EY finding that 67% of customers are currently unwilling to travel more than three miles to shop.

This change in shopping behavior has led to a massive increase in online retail, reaching $3.9 trillion in global revenue in 2020.

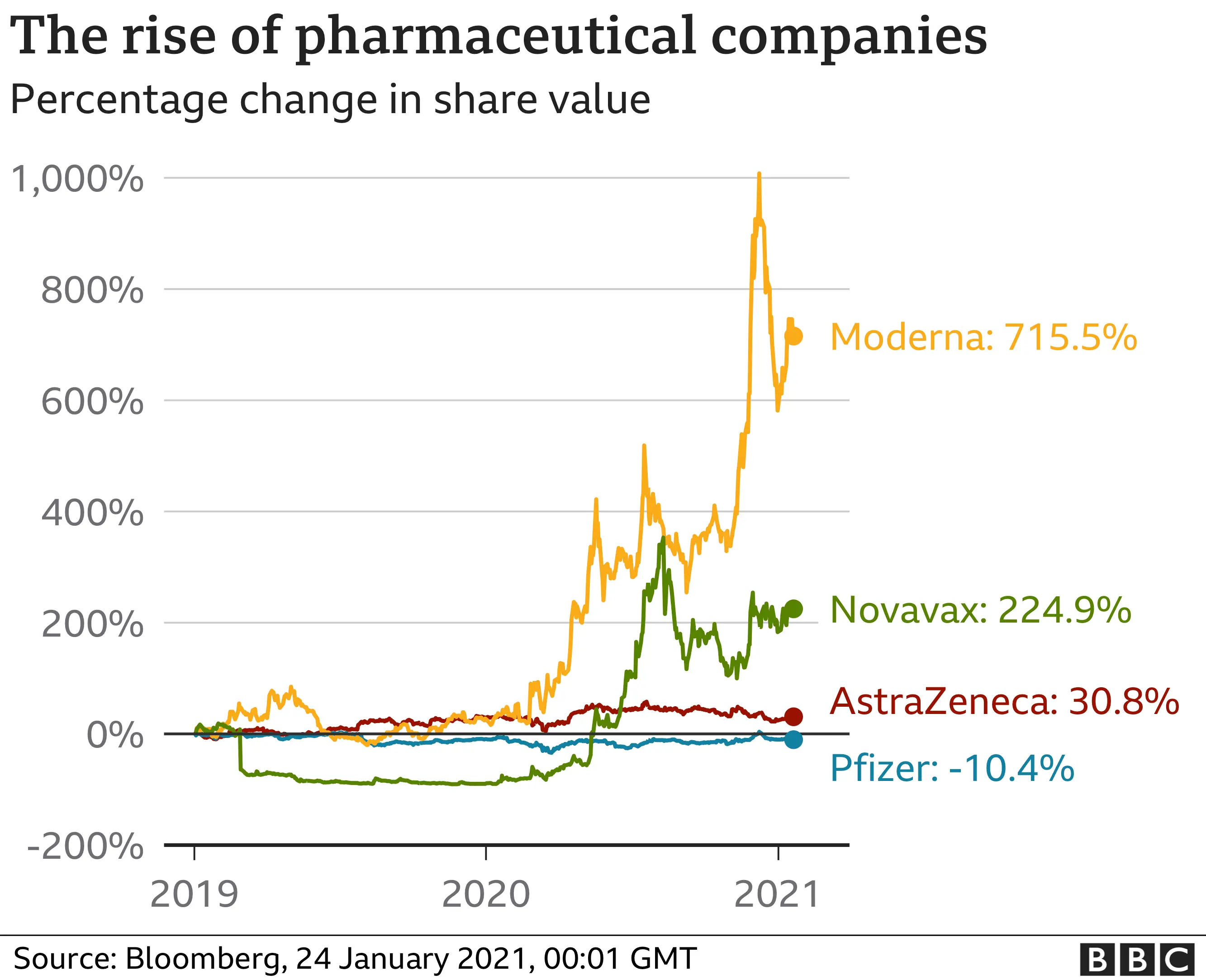

Pharmaceutical companies are winners too

Governments around the world have pledged billions of dollars for COVID-19 vaccines and treatment options.

Shares in some pharmaceutical companies involved in vaccine development have soared.

Shares of Moderna, Novavax and AstraZeneca all saw big gains, while Pfizer shares fell as investors’ confidence in the company’s ability to grow revenue in 2021 dwindled due to its partnership with BioNTech, the high costs of producing and administering a vaccine, and a growing number of similarly sized competitors.

Many pharmaceutical companies have already started distributing vaccines and many countries have begun vaccination programs, with more companies, including Johnson & Johnson and Sanofi/GSK, expected to join the vaccine distribution effort in 2021.