The prospect of continued inflation and further monetary tightening is pushing up interest rates on government bonds, corporate debt, mortgages and consumer credit. As a result, household and corporate spending is slowing broadly.

The coming months are likely to see the economies of Europe and North America, which produce half of the world's output, slide into recession, which will slow growth in the rest of the world through trade and capital flows.

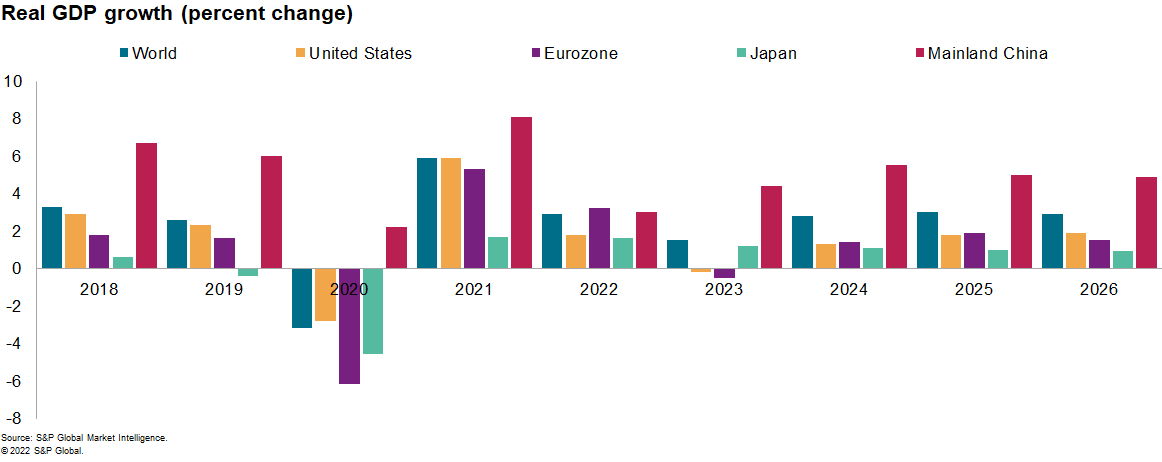

Moderate growth in Asia Pacific, the Middle East and Africa will help the global economy avoid a downturn, but growth is expected to remain below potential in 2023. Global real GDP growth is projected to slow from 5.9% in 2021 to 2.9% in 2022 and 1.5% in 2023.

Tightening monetary policy will ultimately succeed in containing inflation, lowering interest rates, and lifting global growth to 3% by the mid-2020s.

Global economic outlook

S&P Global Market Intelligence's forecast does not anticipate a global economic recession.

Global population is projected to grow by 0.9% in 2023, and our 1.5% real GDP growth forecast represents a modest increase in real GDP per capita of 0.6%.

Sustained growth in emerging markets in Asia Pacific, the Middle East, and Africa will keep the global economy moving forward. While growth in developed economies as a whole is projected to stagnate in 2023, emerging markets will achieve real GDP growth of 3.2%.

With inflation moderating and monetary policy easing, we expect global real GDP to rise to 2.8 percent in 2024 and 3.0 percent in 2025, close to potential output growth.

US Economic Outlook

Following upbeat reports on retail sales and earnings in key service industries, we are revising upwards our third-quarter real GDP growth (from 2.6% annualized) and forecasting modest consumer-led growth in the fourth quarter of 2022.

But the path to 2% inflation will inevitably be painful, and we continue to forecast a recession in the first half of 2023, driven primarily by declines in residential investment, commercial construction, and consumer spending on goods.

The U.S. unemployment rate is likely to rise from 3.7% in October 2022 to a high of 5.7% by the end of 2023. After falling 0.2% in 2023, we forecast real GDP to grow 1.3% in 2024 as inflation subsides and interest rates fall.

Inflation outlook

After much delay, major central banks are continuing to make determined efforts to contain inflation through interest rate hikes and net asset sales, resulting in tighter financial conditions and increased volatility.

By March 2023, policy rates are expected to reach as high as 4.75-5.00% in the US, 4.25% in Canada, 4.00% in the UK and 2.75% in the Eurozone. These monetary policy shifts will affect economic activity with “long and variable” lags.

Inflation has peaked and is expected to slow significantly in 2023 and 2024. Globally, consumer prices are estimated to have risen 8.3% year-on-year in October, up significantly from the cyclical low of 1.3% in November 2020 and the fastest pace since 1995. October's price acceleration was highlighted by year-on-year inflation rates of 11.6% in Germany, 11.1% in the UK and a record high of 10.6% in the euro area.

We expect global inflation to start easing soon, driven by tightening financial conditions, softening demand and easing supply conditions.

Downward price pressures are already underway, as widely reported in S&P Global Purchasing Managers' Surveys, and the commodity price correction is nearing its end due to limited spare capacity in energy and metals markets.

However, lower prices for intermediate and finished goods should provide some relief to consumers as demand weakens. Global consumer price inflation is forecast to ease from 7.7% in 2022 to 5.1% in 2023 and 3.0% in 2024.

Labour shortages pose upside risks to the inflation outlook, most pronounced in countries where labour force participation rates have not fully recovered from the COVID-19 pandemic and where immigration and foreign worker inflows are declining.

Rising unemployment will ease upward pressure on wages in Europe and North America, but it could take more than two years to bring inflation down to central bank targets.

Winter in the Eurozone

The eurozone is facing a winter recession as sky-high energy prices erode household purchasing power.

Assuming normal winter weather and adequate energy supplies, euro area real GDP is projected to expand 3.2% in 2022, then contract 0.5% in 2023, before recovering 1.4% in 2024.

The main downside risks are colder winters, depletion of gas stores and energy rationing, particularly in the industrial sector. Germany, Austria, Poland, the Czech Republic and Slovakia are at highest risk, reflecting their past reliance on Russian energy and the integration of manufacturing supply chains. Higher relative energy costs are a longer-term threat to the competitiveness of European manufacturing.

Mainland China

Mainland China's economic growth remains slow, with real GDP growth picking up to 3.9% year-on-year in the third quarter from just 0.4% in the second quarter, driven by growth in the industrial sector.

Weak data on retail sales, services output and exports in October pointed to a fragile economic recovery, and a widespread increase in COVID-19 infections in November could lead to a further setback.

While government policy has shifted towards supporting economic growth and financial support for property developers could help lift the economy, a strong recovery in the real estate sector is not expected.

Real GDP growth is expected to slow to 3.0% this year from 8.1% in 2021 before rising to 4.4% in 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, a division of S&P Global.