(Bloomberg) – The outlook for the global economy is improving, the OECD said, as economic growth becomes more resilient and inflation is expected to cool in many countries faster than previously expected.

Most Read Articles on Bloomberg

The Paris-based group said the risks were “becoming more balanced”, although conflict in the Middle East and continued price rises could still shake the economy from its more stable footings.

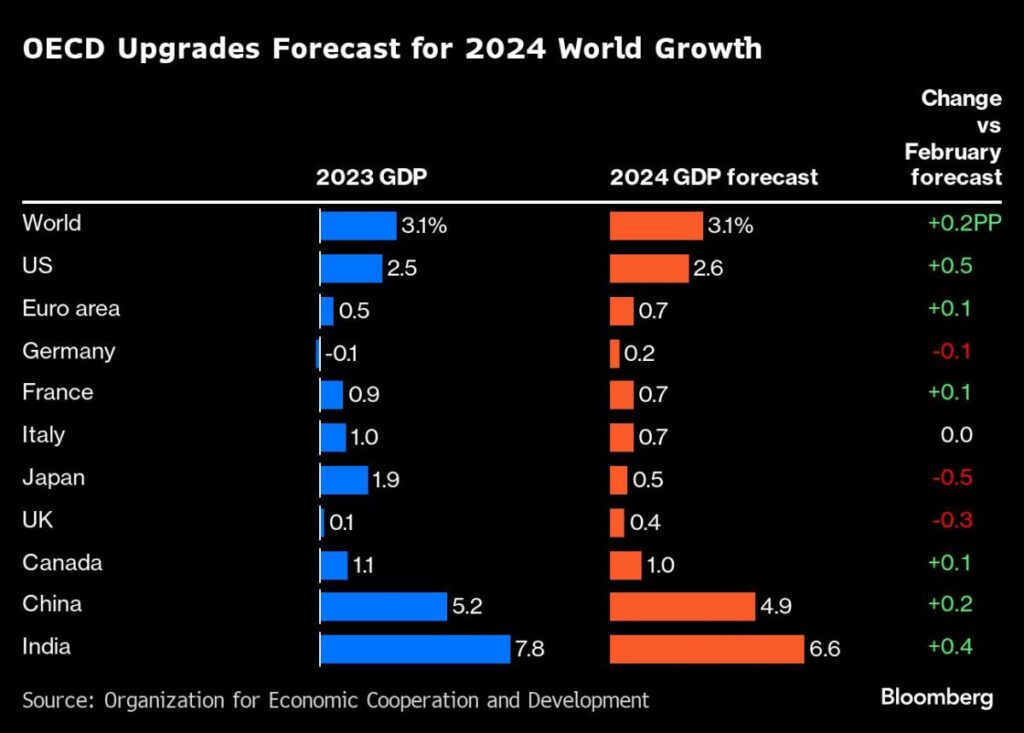

The OECD has raised its global growth forecast for 2024 to 3.1% from 2.9% in February, following notable improvements in expectations for the United States, China and India. The expansion will continue next year at 3.2%.

The positive outlook is that the global economy remains in a stagflation rut (a period of slowing growth mixed with rising unemployment and rising inflation), even if the pace of expansion does not quickly return to the 3.4% average of the pre-pandemic years. It shows that you are trying to avoid falling into. And the energy crisis.

Inflation will be slower than the OECD forecast three months ago, except in the United States, where it expects prices to rise 2.5% this year instead of 2.2%. Still, U.S. policymakers said they should be able to cut rates in the second half of this year.

In Washington on Wednesday, Federal Reserve Chairman Jerome Powell maintained expectations for a rate cut in 2024, but acknowledged that soaring inflation has diminished policymakers' confidence that price pressures are easing. Ta.

The OECD's assessment confirms the slightly more positive views of other international organizations, including the International Monetary Fund, which also raised its forecast last month.

Read more: Factories around the world are slowly starting to gear up again

“Despite modest growth and the persistent shadow of geopolitical risks, cautious optimism is beginning to take hold in the global economy,” said Claire Lombardelli, the OECD's chief economist. “Inflation is easing faster than expected, the labor market remains strong, and unemployment is at or near record lows.”

The OECD said the disconnect between strong US growth and weaker Europe in the economic recovery will continue in the short term, creating a “mixed macroeconomic situation”. This will lead to a difference in the pace of rate cuts, with the European Central Bank expected to start easing before the Fed.

story continues

Still, the OECD said monetary authorities should be cautious as the conflict could push up energy prices and inflation, and the relief of cost pressures in the services sector could be slower than expected.

“Monetary policy must remain prudent to permanently contain potential inflationary pressures,” the OECD said.

For the government, he said, improving economic conditions are an opportunity to address a ballooning debt burden that risks growing further as borrowing costs rise. He also warned that countries face increased spending demands due to aging populations, climate change and the need to strengthen defense.

“There are concerns about the fiscal situation in the medium to long term,” Lombardelli said. “A strong medium-term approach to contain spending, build revenue, and focus policy efforts on structural reforms that promote growth is all needed.”

–With assistance from James Regan.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP