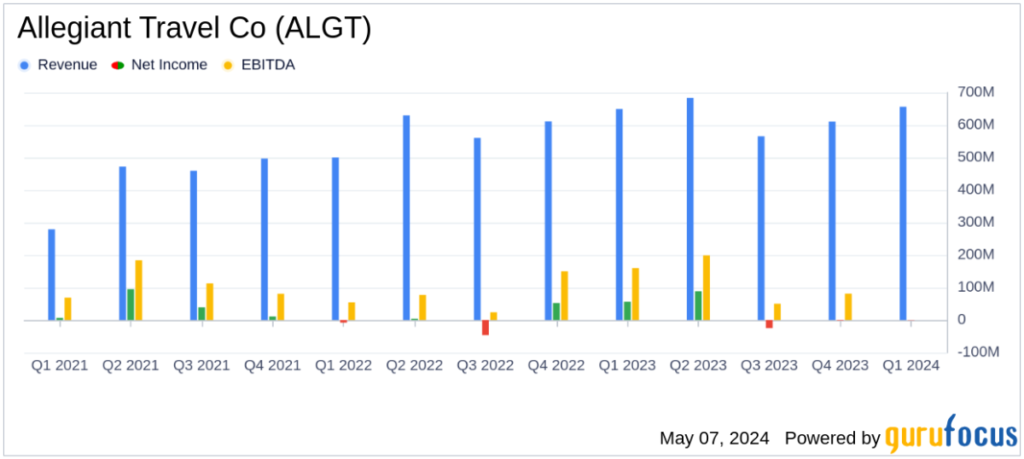

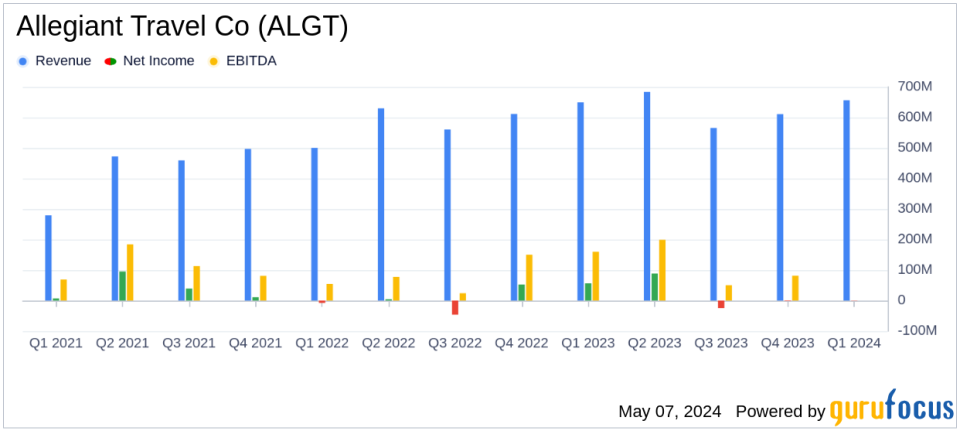

Revenue: Reported at $656.4 million, a slight increase of 1.0% year-over-year and beat estimates of $644.27 million.

Net Income: Net loss was reported at $900,000, significantly down from the prior year's net income of $56.1 million and below the expected net income of $11.65 million.

Earnings Per Share (EPS): GAAP diluted loss per share of $(0.07) and adjusted EPS (excluding special charges) of $0.57, exceeding expectations of $0.50.

Operating income: Dropped 83.8% to $15.4 million from $94.8 million a year ago.

Airline-only revenue: $632.5 million, down 2.6% from $649.7 million a year ago.

Airline-only operating income: Dropped 75.2% to $24.2 million, demonstrating challenges in airline operations.

Special charges: Includes $14.9 million related to accelerated depreciation of aircraft and $1.8 million for property damage to Sunseeker Resort that impacted financial results.

On May 7, 2024, Allegiant Travel Company (NASDAQ:ALGT) released its 8-K report, revealing a complex financial picture for the first quarter of 2024. The company reported his GAAP loss per diluted share ($0.07). Earnings per share (excluding special charges) were $0.57, beating analysts' expectations of $0.50. Total operating revenue increased 1.0% year over year to $656.4 million, exceeding expectations of $644.27 million. However, net income decreased significantly, with a loss of $900,000 reported on an estimated net income of $11.65 million.

Allegiant Travel Co (ALGT) Q1 2024 Earnings: Mixed results amid operational challenges

Company Profile

Las Vegas-based Allegiant Travel Co provides travel services primarily in the United States, with a focus on connecting travelers from underserved cities to major vacation destinations with low-cost, nonstop flights. I'm leaving it there. The company operates airlines, Sunseeker resorts, and other non-airline businesses, offering a wide range of services from air transportation to hotel reservations and car rentals.

Operational highlights and strategic challenges

The first quarter brought significant operational accomplishments and challenges for Allegiant. The company highlighted its controllable completion rate of 99.7% and superior customer service performance, reflected in its high Net Promoter Score. However, this quarter was not without its challenges. Allegiant faced headwinds including delays in aircraft deliveries from Boeing, integration issues with a new reservation system called Navitaire, and lower aircraft utilization rates that impacted operating margins.

story continues

This period also saw Sunseeker Resort's first full quarter of operation. Despite exceeding expectations for F&B revenue, the resort is still in the early stages of reaching financial maturity. The resort's performance is significant because it represents a significant diversification of Allegiant's business model beyond airline operations.

Financial performance analysis

Allegiant's first quarter 2024 financial performance was mixed. While the slight increase in total operating revenue is a positive indicator, a significant 83.8% decline in operating income to $15.4 million was offset by an increase in operating expenses, which jumped 15.5% to $641 million. This highlights the financial burden caused by The aviation-only segment reported a 2.6% decline in operating revenue and a 75.2% decline in operating profit, indicating significant pressure on operating costs.

Future outlook and guidelines

Looking forward, Allegiant provided guidance for the second quarter of 2024, projecting airline-only earnings per share (excluding special charges) of $1.25 to $1.75. The company expects system ASM change to be approximately -1.0% year over year. Although Allegiant expects continued challenges in the full year, it remains optimistic about integrating MAX aircraft into its fleet and unlocking further potential from its Navitaire reservation system.

Allegiant's management team remains committed to navigating these operational and financial challenges through strategic initiatives aimed at improving service delivery and operational efficiency. Successful integration of new aircraft and technology systems is critical to achieving anticipated performance and customer satisfaction improvements.

Investor and Analyst Perspective

From an investment perspective, Allegiant's performance has been mixed, and its ongoing challenges present a delicate picture. While the company's ability to beat revenue expectations is commendable, its net income numbers and operational challenges highlight areas of concern. Investors and analysts will be watching the company's strategic response to these challenges and its subsequent financial performance in the coming quarters.

For detailed financial analysis and future updates on Allegiant Travel Co, visit GuruFocus.com.

For more information, see Allegiant Travel Co's full 8-K earnings release here.

This article first appeared on GuruFocus.