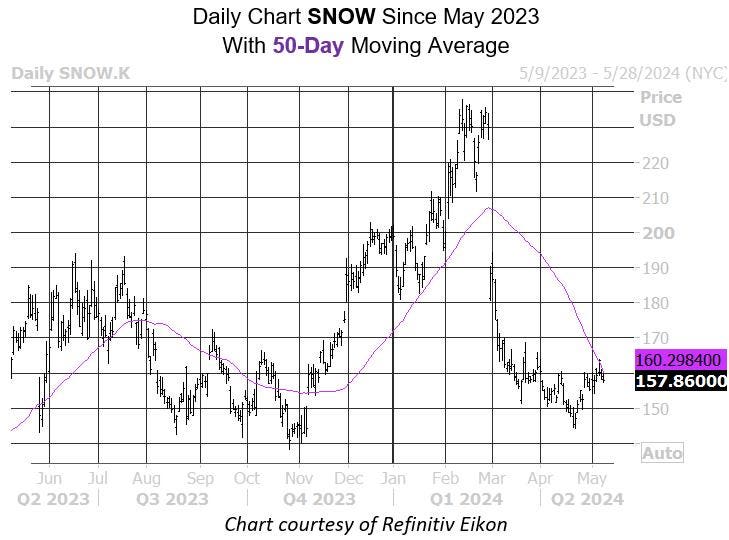

Snowflake (SNOW) has struggled to break above the $160 level over the past few months. The stock is well below February's bear gap and is down 20.5% since the beginning of the year. If the past is any precedent, cloud stocks are about to face more technical troubles.

SNOW is currently one standard deviation from its 50-day moving average. For the purposes of this study, Rocky White, Senior Quantitative Analyst at Schafer & Co., defines this as a stock that has traded below its moving average 80% of the time over the past two months and over the past 10 sessions. We define it as ending south of the trend line in 8 innings. Over the past three years, White said, stocks have seen similar signals seven times, with 71% of them falling a month later, with an average decline of 6.1%. Such a move from Snowflake stock's current perch of $158.02 would send the stock just above $148 and closer to April's lows.

Refinitiv Akon

Of the 41 stocks covered, 29 remain rated “buy” or higher, so a downgrade in one or two stocks could be a headwind. Additionally, the 12-month consensus price target of $218.36 is a 38% premium to current levels, leaving plenty of room for a lower price target.

There remains some optimism that options traders' tensions will be resolved. SNOW's 10-day call/put volume ratio on the International Stock Exchange (ISE), CBOE Options Exchange (CBOE), and Nasdaq OMX PHLX (PHLX) is 3.36, which ranks in the 90th percentile of its annual range and ranks among traders. That means far more calls.・It's more biased than usual.

When considering the next move for Snowflake stock, options seem like a good way to go. This is based on 40% of the stock's Schaefer Volatility Index (SVI), which puts it in the low 17th percentile of its annual range. This means options traders are currently pricing in low volatility expectations.