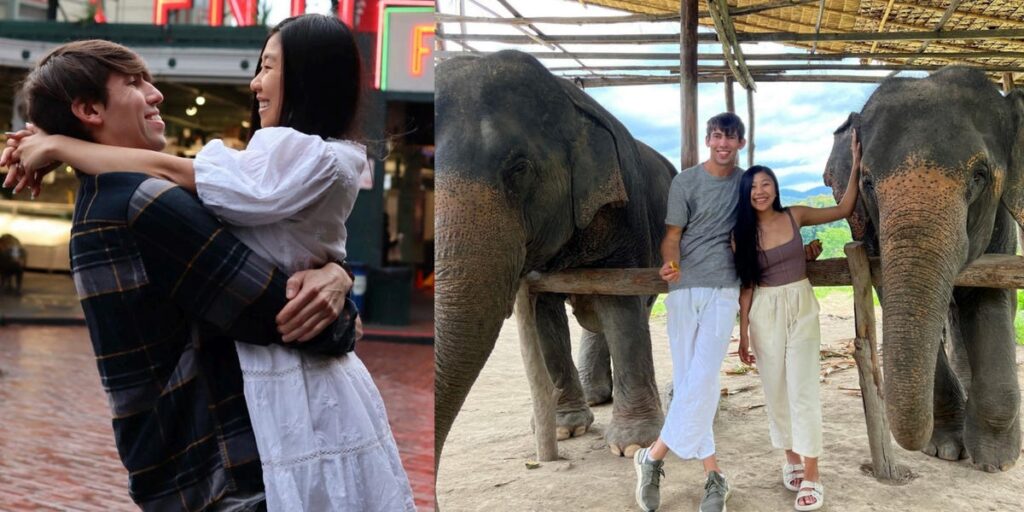

Downward Angle Icon An icon in the shape of a downward angle. Ms. Fisher said that not having children has given her the freedom to travel with her husband. Courtesy of Natalie Fisher. Natalie Fisher and her husband Keldon are her DINK. We are a married couple, both working and no children. In July 2023, Fisher quit his tech job and became a full-time content creator. Being a DINK means Fisher can travel, own a home, and take risks in a new career.

This spoken essay is based on a transcribed conversation with Natalie Fisher, 25, of Washington, about her experiences in a DINK (dual income, no children) relationship. The following has been edited for length and clarity.

When my husband Keldon and I first got together in January 2018, we knew we weren't ready to have kids.

I was 20 and he was 25. We were very young and wanted to experience the world and cooperate financially first.

Keldon is currently a software engineer. He took a job in marketing after college, but in 2020 he became a data analyst for a Washington-based energy company. In 2021, he started earning more than $100,000 a year. We were tech DINKs (meaning dual income) and didn't have kids.

Although we would like to have children in the future, we both agree that now is not the time. With both of us working and no kids, we were able to buy a house, pay for a wedding, save more, and travel. I even quit my 9-to-5 job to pursue my passion for content creation.

Engineers are also being laid off one after another. Because of these factors, I feel that I made the right decision in delaying having children.

During the technology DINK era, we splurged and traveled a lot.

As tech DINKs, Keldon and I had a lot of discretionary income, so we were able to splurge on whatever we wanted.

We both worked east of Seattle and would meet up after work to eat out and watch movies. We've been working incredibly hard and we saw it as a way to reward ourselves.

In July 2020, we purchased a two-bedroom condo for approximately $500,000. We combined our funds and got pre-approved for a mortgage. It was easy for both of us to afford a home because we could split the down payment evenly.

Since we were sharing the costs, it felt like everything was half the price and we were able to save even more. We both built up emergency funds for his 2022. I have $31,000 in hand. I stopped putting money into it in favor of saving money for my wedding and honeymoon. We were able to save about $20,000 for our wedding in August 2023.

We have a $4,000 travel fund. We also have a home improvement fund and use the extra income to max out a Roth IRA and invest in a regular brokerage account. Our savings strategy was pretty disciplined. You can put just over half of your after-tax income toward financial goals like savings and investments.

Our dog, a Pomeranian, brings a lot of joy to our lives, but he was expensive. The price was about $1,700 when we bought him a month after we bought the house and we were DINKWAD (both working, no kids, 1 dog). We give him lots of treats and pamper him.

Last year, even after I quit my job, Keldon and I were able to travel almost every other month. We already had a home and an emergency fund, so we felt we had the financial security to do this.

We went to places like Rome, Mexico, and Finland. We didn't have kids, so it was great to have the time and freedom to experience the world.

I quit my technical job to become a content creator.

I started making TikToks in 2022 about my personal financial journey. On TikTok, I was told that I was making an impact by teaching new things about finance. In 2022, he earned $40,000 in revenue from content creation, and in 2023, he earned $107,000 excluding expenses.

Most of my income from content creation in 2023 came from UGC (user-generated content) that I created for fintech companies to use on their social media platforms.

In my job as a data analyst, I was crunching numbers, but it was very difficult to feel like I was making an impact. I quit my 9 to 5 job in July 2023 to pursue content creation full time.

Last year felt like the perfect time to take the risk of quitting my job because I'm still young, have savings, and don't have the scary responsibility of raising a child. Being a DINK was a big reason I had savings and was able to take that risk.

Before I quit my job, content creation was a side income on top of my salary. My income fluctuates wildly from month to month, so I have to adjust my lifestyle.

We are very grateful to have a supportive partner like Keldon. In months when I have less income from the business, he contributes more to expenses than I do. He is a steady rock and we definitely couldn't do this without him.

Without a steady income, I decided to limit my spending even more this year.

It seems the glory days are over. I eat out less and travel less. This year, we planned a big trip together this summer.

I decided to give myself a salary of $35,000 in 2024 from my content creation business. Keldon made over $100,000 last year, so we're still wealthy, but I'm still trying to be more frugal and financially conscious.

I hope the risk pays off. Since I can create content without having to go to the office, I would like to build a flexible career that I can continue while raising my children.

I want to achieve financial milestones before becoming a parent.

I think we made the right decision in waiting to have a child. If I were already a parent, I would regret it so much. Keldon and I are both in the early stages of our careers and have yet to make a name for ourselves.

We feel the situation is uncertain as layoffs are occurring in the economy, particularly in the technology industry. We all want to achieve certain financial milestones before we become parents. We would like to have a net worth of $1 million and a fund to cover medical and childcare costs for the birth of our child.