Tech markets have a long history of delivering significant and consistent returns to investors. In fact, over the past decade, the Nasdaq 100 technology sector is up 416%, significantly outpacing the S&P 500 (up 178%).

Technology companies tend to benefit from the innovative nature of the industry, with its never-ending demand for software and hardware upgrades. As a result, it's no surprise that the five most valuable companies in the world are all technology companies, including Microsoft, Apple, Nvidia, Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), and Amazon.

These companies have created many millionaires over the years and are likely to create even more millionaires in the future. Therefore, it is worth dedicating some of your holdings to high-growth sectors, which could benefit from technological developments over the years.

Here are two top tech stocks that could make you a millionaire.

1. Advanced microdevices

Advanced Micro Devices (NASDAQ: AMD) has a long way to go before it can compete with top technology companies. The company's $246 billion market capitalization is still significantly lower than market leader Nvidia's more than $2 trillion. But that's why AMD has the potential to become a billionaire and has plenty of room to run.

The chip market is booming, and demand is likely to continue to grow as technological advances increase the need for high-performance hardware. For example, demand for chips soared last year due to growing interest in artificial intelligence (AI). Nvidia's dominant role in graphics processing units (GPUs) has allowed it to gain a head start in this field, gaining a majority market share with its AI chips in 2023.

However, AMD has invested heavily in AI and launched rival GPUs this year. And those efforts seem to be bearing fruit. The company announced its first-quarter 2024 earnings on April 30, with sales up 2% year over year and $20 million more than Wall Street expected. AMD benefited from an 80% jump in its AI-focused data center division and an increase in GPU sales.

AMD's GPU market share increased from 12% to 19% between Q4 2022 and Q4 2023. Meanwhile, Nvidia's GPU market share fell from 86% to 80% during this period. AMD is profitable in the industry and could be a good long-term investment.

AMD's stock price has risen 460% in the past five years alone, but could surpass that in the next five years as it digs deeper into AI. Meanwhile, AMD's price-to-sales (P/S) ratio of 11 is significantly lower than Nvidia's 37, suggesting the company's stock is trading at a much better value than its largest competitor.

story continues

2. Alphabet

AMD is a great way to add an up-and-coming company to your portfolio, but with one of the strongest positions in the technology industry, Alphabet stock is a reliable choice. Internal brands like Android, YouTube, Chrome, and Google have created a vast user base of billions of consumers and businesses.

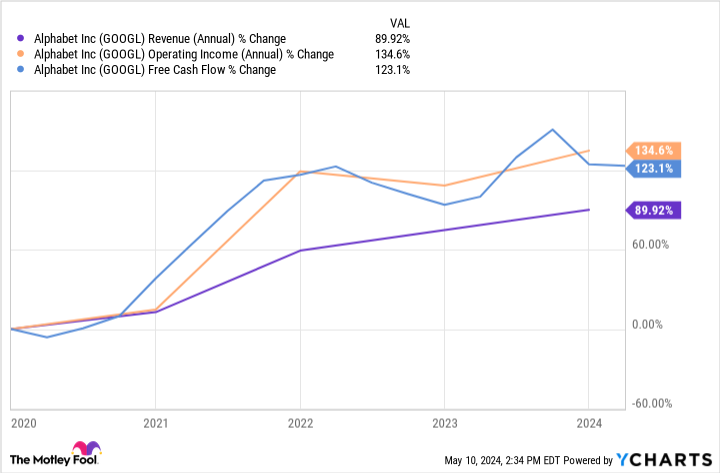

GOOGL Revenue (Annual) Graph

The company has achieved promising growth due to its success over the years, and this graph shows how the company's annual revenue, operating profit, and free cash flow have increased significantly since 2020. Meanwhile, the company's stock price rose 143% during the same period.

Past growth is not necessarily indicative of future growth. But Alphabet's future is bright. The company leverages its vast user base to become a leader in digital advertising, with advertising sales accounting for the majority of its revenue. And now, that same user base appears to be helping the company become a major AI company.

Alphabet announced its 2024 first-quarter results on April 25, with net sales up 15% year-over-year and nearly $2 billion higher than expected. The company saw solid growth in its advertising business, with Google services revenue increasing by his 14%. However, the area with the most potential for growth was Google Cloud, which saw a 28% year-over-year revenue increase.

Over the last year, Alphabet has gradually expanded its AI cloud services on Google Cloud, adding new tools and launching an AI model called Gemini. Meanwhile, in April, the company announced plans to spend $3 billion building data centers in Indiana and Virginia to further promote Google Cloud.

Alphabet is a healthy company with a strong position in the technology sector. The company is still relatively early in its AI venture, making now a great time to invest.

Additionally, Alphabet's P/S of 7 is lower than many of its rivals in the AI space, so the company's stock is easy to buy now and could make you a billionaire with the right investment. It has become a certain stock.

Should you invest $1,000 in Advanced Micro Devices right now?

Before buying Advanced Micro Devices stock, consider the following:

Motley Fool Stock Advisor's team of analysts has identified the 10 best stocks for investors to buy right now. Advanced Micro Devices was not among them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Nvidia created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, you would have earned $550,688. *

Stock Advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month. Stock Advisor services have increased S&P 500 returns more than 4x since 2002*.

See 10 stocks »

*Stock Advisor will return as of May 13, 2024

Suzanne Frey, an Alphabet executive, is a member of the Motley Fool's board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool's board of directors. Dani Cook has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, and his Nvidia. The Motley Fool recommends the following options: His January 2026 $395 long call on Microsoft and his January 2026 $405 short call on Microsoft. The Motley Fool has a disclosure policy.

2 Top Tech Stocks That Can Make You a Millionaire was originally published by The Motley Fool