The travel and leisure scene could provide momentum heading into the summer travel season.

Source: OPOLJA / Shutterstock.com

With the summer travel season fast approaching, some investors may be thinking that now is a good time to take a look at the many travel and leisure stocks that are overdue a boost. While the summer travel season may bring a much-needed boost, the increased travel demand will not magically erase the various headwinds consumers face. Inflation, while slowing, is still a bit too high. The effects of last year's inflation could hurt for a long time.

Either way, here are three travel stocks to keep an eye on to make the most of the strong seasonal times. I see a path to greater heights for the company as they invest wisely in technology while cutting various expenses, but now that we have officially passed the halfway point of Q2 2024. Some companies seem too cheap.

Airbnb (ABNB)

Source: sdx15 / Shutterstock.com

In my opinion, Airbnb (NASDAQ:ABNB) stock is under pressure after management released pretty lackluster guidance after a quarter that deserved a rise in the stock price.

Summer travel could fuel hot travel demand and set the stage for a bigger-than-expected beat, but Airbnb is reportedly listening to feedback from customers tired of the added costs. Sure, it can be a frustrating experience to book accommodation and have hefty fees added on. Specifically, customers are fed up with additional cleaning fees.

When you factor in these fees, it may not end up being significantly cheaper to book an Airbnb stay than a hotel or motel room. Either way, I think the novelty and uniqueness of some Airbnb stays continues to work in their favor.

Additionally, technology can help customers save money without impacting operating margins. Using AI to handle guest-host disputes is just one way that technology can help Airbnb deliver lower prices and higher satisfaction. An AI-powered concierge is another path to growth and profitability.

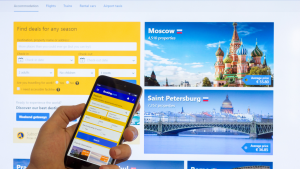

Booking Holdings (BKNG)

Source: Andrei Solovev/Shutterstock

Booking Holdings (NASDAQ:BKNG) stock has soared, with the stock up more than 43% over the past year. The travel agency just posted impressive first quarter sales and profits. One reason stocks are starting to rise ahead of the summer travel season is the increase in the number of travelers. I suspect the recent momentum could grow even further as summer approaches.

Despite consumer hardship, many appear intent on continuing to spend heavily on leisure. Indeed, the emphasis on experiential factors (especially among younger consumers) may be why Booking has remained surprisingly resilient. In any case, Booking's strategic bets (e.g. AI personalization) also support a long-term bull case.

Even at near all-time highs, I still like the stock at a price-to-earnings ratio of 28.6.

Hilton Worldwide Holdings (HLT)

Source: josefkubes / Shutterstock.com

Hilton Worldwide Holdings ( NYSE:HLT ) stock is a major hotel chain that benefits from a strong travel season. The stock price has steadily increased by about 44% over the past year. Like Bookings, Hilton also had a very impressive first quarter with revenue that beat analysts' expectations. Additionally, the company raised its full-year guidance, prompting a jump in its stock price.

With Hilton Honors' impressive loyalty program helping drive impressive booking numbers, HLT stock appears to be one of the best lodging options for investors looking to capitalize on the summer travel boom.

At the time of writing, HLT stock has a P/E ratio of 44.5x. It's not a cheap stock. However, given its strong loyalty program and pipeline of luxury hotels, we see many factors that justify the premium price.

On the date of publication, Joey Frenette did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the author and are subject to the InvestorPlace.com Publishing Guidelines.

Joey Frenette is an experienced investment writer specializing in technology and consumer stocks. A contributor to Motley Fool Canada, TipRanks, and Barchart, Joey excels at finding mispriced stocks with long-term growth potential in fast-paced markets.