Trade deals, advanced technology and security are likely to be high on Sheikh Mohammed's agenda as he visits South Korea and China this week.

The visit comes at a time when the UAE, the Arab world's second-largest economy, is promoting technological advances, making strategic investments and strengthening economic ties with other countries as it seeks to move away from an oil-dependent economy.

Sheikh Mohammed begins a two-day official visit to South Korea on Tuesday and is due to make an official visit to China on Thursday.

“I think the main objective of Sheikh Mohammed's visit to South Korea and China is to enhance their access to advanced technology,” Kondo Shigeto, a senior research fellow at the Energy Economics Center at the Institute of Energy Economics, Japan, told The National.

“Various industries, including energy-related ones, are developing in these two East Asian countries, and I believe they are seeking technology transfer to their countries.”

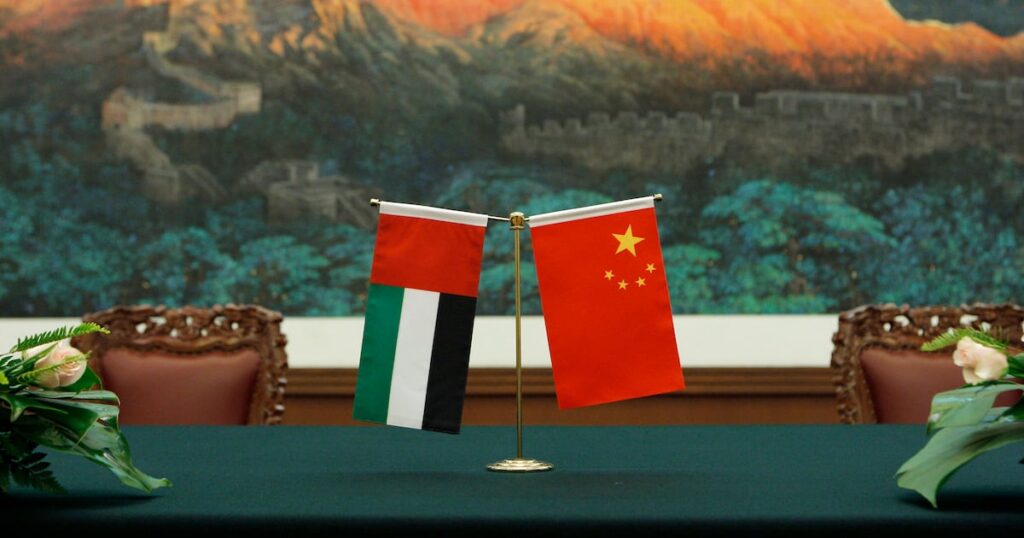

China

The UAE is China's largest trading partner in the Arab world, with trade and investment spanning many sectors, including crude oil, petrochemicals and artificial intelligence.

Chinese investment in the UAE reached $1.3 billion last year, up more than 16 percent from the previous year, Zhang Yiming, China's ambassador to the UAE, said at an event in Abu Dhabi last week.

Zhang said the UAE increased its investment in China by 120 percent last year, accounting for “90 percent of Arab countries' investment in China.”

China is also strengthening its ties with the rest of the world amid growing pressure from the United States over investments and goods exports to the world's largest economy.

Earlier this month, U.S. President Joe Biden announced he would impose heavy tariffs on Chinese imports, including electric vehicle batteries, to protect U.S. industry.

Kondo said the UAE may pursue a free trade agreement with China as recent reports suggest that FTA negotiations between China and the GCC have stalled.

He said the delay was due to concerns that an influx of Chinese goods could hinder Saudi Arabia's industrial growth.

Last month, Abu Dhabi and Kiev finalized the terms of a Comprehensive Economic Partnership Agreement (CEPA), which is expected to boost Ukraine's economy amid economic turmoil caused by two years of war with Russia.

The agreement marks the 15th CEPA that the UAE has introduced, formally signed or successfully negotiated with countries in Africa, Asia, Europe and South America.

To date, 11 agreements have been signed with India, Turkey, Israel, Indonesia, Cambodia, Georgia, Mauritius, Kenya, the Republic of Congo, Colombia and Costa Rica.

“The UAE continues to show a willingness to negotiate bilateral FTAs with other countries rather than within the Saudi-led GCC framework,” Kondo said.

Non-oil trade between the UAE and China is expected to exceed 264.2 billion dirhams ($72 billion) in 2022, up 18% from 223.8 billion dirhams in 2021, official data showed.

“Energy remains at the heart of the UAE-China burgeoning relationship, but has gone beyond that in recent years,” Nasser Saidi, Lebanon's former economy minister, told The National.

Saidi said the UAE could benefit from linking its financial markets with Shanghai and Hong Kong, which would greatly facilitate capital flows.

Potential collaboration could also include the introduction of the yuan in trade and the expansion of China's cross-border interbank payments system, which is being considered as an alternative to the SWIFT payments system, he added.

South Korea

President Sheikh Mohammed greets South Korean President Yoon Seok-youl in Abu Dhabi in January 2023. The two countries have close business ties. Hamad Al Kaabi/Presidential Palace

President Sheikh Mohammed greets South Korean President Yoon Seok-youl in Abu Dhabi in January 2023. The two countries have close business ties. Hamad Al Kaabi/Presidential Palace

The UAE is currently in talks to conclude new agreements with Serbia, Vietnam, the Philippines, New Zealand and Ecuador, and has completed negotiations with South Korea.

Wham reported last year that the trade agreement with South Korea aims to strengthen East-West supply chains, enable two-way foreign direct investment flows, and improve collaborative research and knowledge exchange across sectors such as energy, advanced manufacturing, technology, food security and healthcare.

Korea Electric Power Corporation and a group of Korean conglomerates built all four units of Abu Dhabi's $20 billion Barakah Power Plant. The plant, which began operations in April 2021, was built to meet the UAE's domestic electricity needs.

Kondo said there was a “high possibility” that a Korean company would win the contract for the UAE's second nuclear power plant.

Reuters reported last month, citing sources, that the UAE plans to invite bids this year for four new nuclear reactors.

The UAE Nuclear Energy Company told The National that it was exploring opportunities both within the UAE and abroad to take advantage of an expected expansion of nuclear energy projects around the world.

“We look forward to working with the strongest companies in the market, including our colleagues in South Korea, to drive the next stage of nuclear energy development both domestically and internationally,” said Mohammed Al Hammadi, Enec's Managing Director and CEO.

“This official visit is an opportunity to celebrate successful cooperation with our Korean partners in this growing global sector.”

According to WAM, the UAE is South Korea's second-largest trading partner among Arab countries and its 14th-largest trading partner in the world, accounting for 20 percent of trade between East Asian countries and Arab countries.

By the end of 2022, South Korean investment in the UAE rose to $2.2 billion, while UAE investment in South Korea reached $578 million.

Last updated: May 28, 2024 7:29 AM