The stock market is in a bit of a lull due to concerns that the Federal Reserve may not be ready to cut interest rates until September. Arguably, the possibility of a June rate cut was pretty low to begin with. In any case, a “slightly prolonged high” kind of environment could slightly dampen the market's upward trend, even though the artificial intelligence (AI) boom is still in full swing.

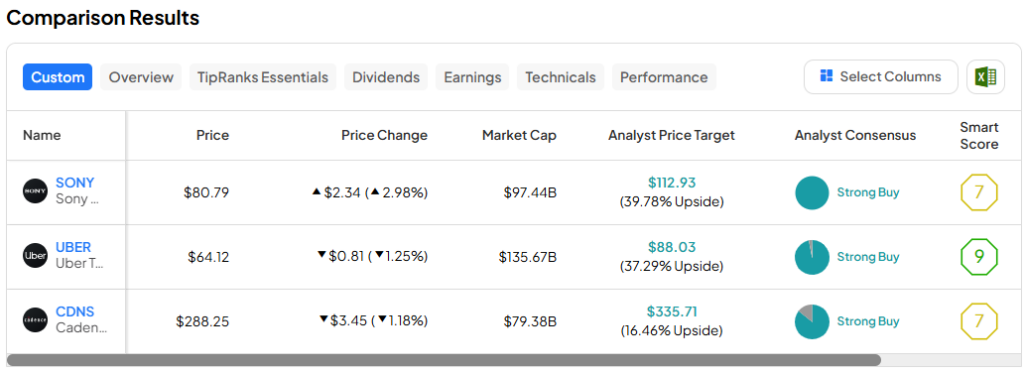

As the market rally slows, the following highly-valued tech stocks could be worth buying into. In this article, we'll use the TipRanks comparison tool to take a look at three very different tech companies, all of which have “strong buy” recommendations according to Wall Street analysts.

Sony (NYSE:SONY)

Sony is a Japanese entertainment company with unique and diverse businesses ranging from film production to music, video games, and electronics. The stock has seen a big surge around the time of its latest earnings announcement, which beat analysts' expectations. While not all segments are doing well at the same time, the company is still well-diversified (and cheap), making it worth investing in here. All things considered, I maintain a bullish view on Sony stock at just over $80 per share.

The entertainment giant reported its latest (Q4) earnings per share (EPS) of $0.99, beating expectations of $0.69. Most notably, its Music, Photography, and Imaging & Sensing Solutions divisions all posted double-digit growth during the quarter. Meanwhile, its Games & Network Services (G&NS) division posted a slower quarterly growth of 2.2%, due in part to lower PlayStation 5 (PS5) shipments.

The PS5 is a great console, but it seems to be having a midlife crisis these days. Indeed, the best-selling console represents a game changer not just for the gaming industry, but for the company as a whole.

With the company preparing a Pro model with a new GPU, the gaming division may finally get a much-needed boost ahead of the launch of the PS6. The console is rumored to feature better ray tracing and AI upscaling, the latter of which could be a literal game changer. Of all the industries that AI could propel into the future, gaming will undoubtedly rank near the top of the list.

While not quite the PS6, I believe the PS5 Pro is the next best thing to a generational shift. Whether or not this will trigger a mid-cycle refresh is the big question. Either way, developers are gearing up for the upgrade, which could result in a steady slate of titles that feel truly next-gen.

The story continues

Given its dominant gaming business and robust movie, music, and electronics businesses, I view Sony's stock as a fantastic trade at 15.7 times earnings, after its stock surged 10% following the earnings release and is now down slightly.

What is your target price for Sony shares?

According to analysts, Sony shares are a “Strong Buy,” with four unanimous Buy ratings over the past three months. The average target price for Sony shares is $112.93, indicating room for upside of 39.8%.

Uber (NASDAQ:UBER)

Uber stock's 2023-2024 bull run is officially over, with the ride-hailing giant's shares down 22% from their all-time highs. The months-long selloff has been a rather steady decline on the back of stellar second-quarter results. No doubt, sobering up on the inflated valuation was necessary, but now that the bear market has calmed the stock, I see Uber stock as a great buy ahead of the summer travel season. As the bear market continues, I remain bullish on the stock.

With travel season in full swing, Uber seems poised to help save customers money with a shuttle-booking service. Such a service comes at a perfect time: Amid inflation, consumers are strapped for cash, and Uber continues to demonstrate the great value proposition of mobility services. Additionally, the company recently partnered with Instacart (NASDAQ:CART) to enhance its restaurant delivery capabilities, which could help attract new customers to try out Uber's app.

Add in the Uber One subscription, which offers discounts on mobility and food delivery services, and expansion to 25 new countries, and it's clear that it's premature to sell Uber shares at a modest forward P/E of 51, near its lowest level in the past year.

What is your target price for UBER stock?

According to analysts, UBER shares are a “Strong Buy,” with 31 Buy and 1 Hold designations over the past three months. The average target price for UBER shares is $88.03, indicating an upside potential of 37.3%.

Cadence Design Systems (NASDAQ:CDNS)

Cadence Design Systems is regaining momentum after experiencing a 15% correction in April. With the AI boom picking up steam again thanks in part to the continued explosive demand for AI accelerators, Cadence is once again inching back to all-time highs and is one of the top-performing AI stocks to watch. Currently, the company's shares are down just 12% from their highs, but could break out of this level if Cadence can surpass the earnings levels it dropped to just over a month ago. All things considered, I remain bullish on CDNS stock.

Going forward, I expect our new Palladium Z3 and Protium X3 systems later this year to accelerate growth. These new products aim to “usher in a new era of accelerated validation, software development and digital twins.” When we hear “digital twins,” we think of AI leader Nvidia (NASDAQ: NVDA), whose technology is essential to powering these advanced models.

In recent quarters, Cadence has been working more closely with Nvidia as the two companies prepare for the launch of an incredible supercomputer, the Millennium M1, that will tackle some of the toughest problems in science and engineering, delivering up to 100x greater design efficiency and 10x greater throughput in precision, speed and scale compared to CPU-only solutions.

The stock is trading at 49.5 times forward earnings, well above the application software industry average of over 30.9 times. Still, given the Z3, X3, and M1 (not to be confused with the first generation of Apple (NASDAQ:AAPL) silicon), I think the premium is well worth paying.

What is your price target for CDNS stock?

Analysts have rated CDNS shares a “Strong Buy,” with six “Buy” and one “Hold” ratings over the past three months. The average target price for CDNS shares is $335.71, indicating an upside potential of 16.5%.

summary

These are the three tech companies analysts are praising that still have room for rapid growth later this year. Entertainment giant Sony, with its presence in numerous media outlets, is objectively the cheapest based on P/E alone. Personally, I think it's the best option. But for those looking for more growth, it's hard to beat CDNS stock given the innovations that could be game-changing next year. At the time of writing, analysts see the most upside potential from Sony stock (~40%).

Disclosure