Even though it wasn't a huge purchase, we think it's good to see that Apiam Animal Health Limited (ASX:AHX) Managing Director and Executive Director Christopher Richards recently spent A$107k to buy shares at A$0.34 per share. That said, this only increased his holding in the company by a small percentage and was not a large purchase in absolute terms.

View our latest analysis for Apiam Animal Health

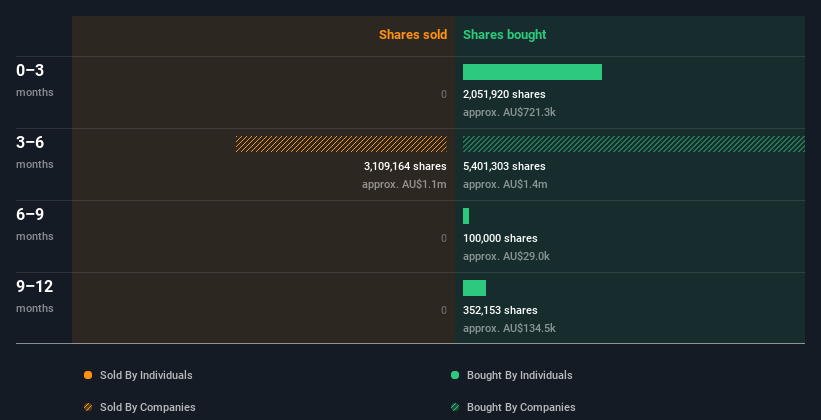

Insider transactions for Apiam Animal Health over the past year

In fact, the recent purchase by MD and Executive Director Christopher Richards is not the only time the company has acquired Apiam Animal Health shares this year. The company previously made a much larger purchase of AUD596,000 worth of shares at AUD0.35 per share. So it's clear that insiders were willing to buy even at a higher price than the current share price (AUD0.34). Their views may have changed since then, but we can see that they were at least optimistic at the time. We always keep a close eye on the prices insiders pay when purchasing shares. We usually like it better when insiders buy at a price higher than the current price, as it shows they valued the stock at higher levels as well.

Apiam Animal Health insiders have bought shares in the last year but not sold any. Below you can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, or you can click on the chart to see all the individual transactions, including the stock price, individual, and date.

Insider Trading Volume

There are always plenty of stocks that insiders are buying, and if you like investing in lesser known companies, then check out this free list of companies (hint: insiders are buying).

Apiam Animal Health Insider Ownership

For ordinary shareholders, it's worth checking how many shares are held by company insiders. We think it's a good sign if insiders own a significant number of shares in the company. Insiders hold 26% of Apiam Animal Health's shares, worth about AU$17m. Admittedly, we've seen higher insider holdings elsewhere, but these holdings are enough to suggest alignment between insiders and other shareholders.

So what does this data suggest about Apiam Animal Health Insiders?

Recent insider purchases are good to see, and the longer term outlook for insider transactions also gives us confidence. Combined with notable insider ownership, these factors suggest that Apiam Animal Health insiders are well-aligned and may think the share price is too low. In addition to knowing about the ongoing insider transactions, it's useful to identify the risks facing Apiam Animal Health. Every company has risks, and we've spotted 4 warning signs for Apiam Animal Health (of which 1 is a bit unpleasant!) you should know about.

The story continues

Of course, you may find great investments by looking elsewhere, so take a peek at this free list of interesting companies.

For the purposes of this article, insiders are individuals who report their transactions to the relevant regulatory bodies. Currently, we count only open market transactions and private dispositions of direct interests, not derivative transactions or indirect interests.

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.