Oriental Food Industries Holdings Berhad (KLSE:OFI) shares will hit their ex-date in 3 days. The ex-date is one day before the record date, which is the date shareholders need to be on the company's books to receive their dividends. It's important to be aware of the ex-date, as all trades in the shares must have settled before the record date. This means that investors who buy Oriental Food Industries Holdings Berhad shares after the 14th of June won't be able to receive the dividend paid on the 10th of July.

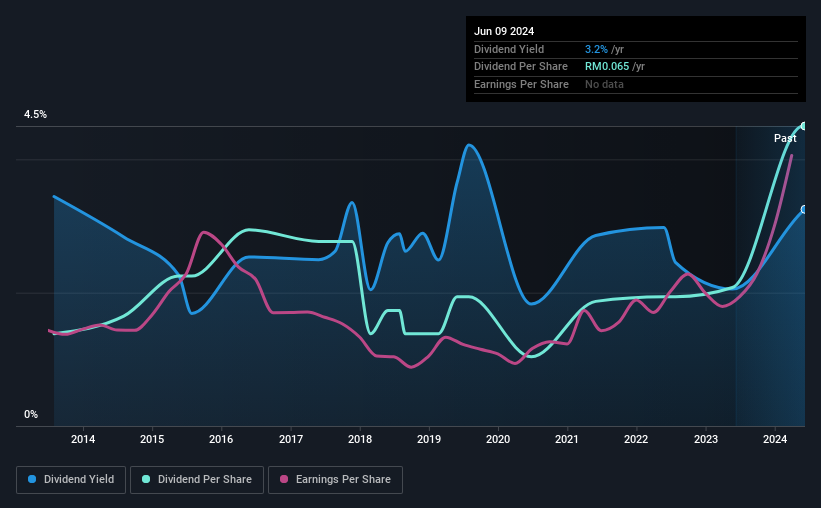

The company's next dividend will be RM00.02 per share, and in the last 12 months the company has paid a total of RM0.065 per share. Based on the last year's payments, Oriental Food Industries Holdings Berhad has a historical yield of 3.3% on its current share price of RM02.00. While it's nice to see a company paying a dividend, it's also important to ensure that it doesn't kill the golden eggs by laying them. We need to check whether the dividend is covered by profits and if the dividend is growing.

Check out our latest analysis for Oriental Food Industries Holdings Berhad

Dividends are typically paid from company profits. If a company pays more in dividends than it earns, the dividend may become unsustainable, which is why it's good to see that Oriental Food Industries Holdings Berhad is paying out a modest 36% of its profits. That said, even highly profitable companies might not generate enough cash to pay their dividends, so we should always check if the dividend is covered by cash flow. The good news is that only 21% of free cash flow was paid out last year.

It's good to see that Oriental Food Industries Holdings Berhad's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Oriental Food Industries Holdings Berhad paid out over the last 12 months.

Historical Dividend

Are profits and dividends increasing?

Companies with consistently growing earnings per share usually make the best dividend stocks, as it is easier to grow dividends per share. If profits fall and the company is forced to cut the dividend, investors could watch the value of their investment disappear. So it is reassuring to see Oriental Food Industries Holdings Berhad's profits are growing fast, increasing at 25% per year for the past five years. Oriental Food Industries Holdings Berhad pays out less than half of its profits and cash flow as dividends, yet at the same time, it has grown earnings per share rapidly. Companies with growing profits but low dividend payout ratios often make the best long-term dividend stocks, because a company can increase its profits and at the same time increase the proportion of its profits it pays out, effectively growing the dividend.

The story continues

Another key way to gauge a company's dividend prospects is to measure the historical rate of dividend growth. Oriental Food Industries Holdings Berhad has averaged dividend growth of 13% per year over the past decade. It's good to see that both earnings and dividends per share have grown rapidly over the past few years.

Final conclusion

Is Oriental Food Industries Holdings Berhad an attractive dividend stock, or is it better left on the shelf? Oriental Food Industries Holdings Berhad has grown earnings per share while simultaneously reinvesting in the business. Unfortunately, the company has cut its dividend at least once in the last decade, but a conservative payout ratio makes the current dividend look sustainable. There's a lot to like about Oriental Food Industries Holdings Berhad that makes it a priority to investigate it more closely.

On that note, you should investigate what risks Oriental Food Industries Holdings Berhad is facing. Our analysis shows 1 warning sign for Oriental Food Industries Holdings Berhad, and you should be aware of this before buying the stock.

If you're looking for stocks with high dividends, we recommend checking out our picks of the top dividend stocks.

Have something to say about this article? Do you have any questions about the content? Contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.