Thanks to the AI boom, hardware stocks are outperforming software stocks for the first time in a decade. Guillaume/Getty Images

Software stocks have fallen sharply this year after a long period of strong performance.

Meanwhile, hardware stocks are seeing profits soar and benefiting from the AI boom.

“We build the cars and the engines, but the software doesn't have the passengers,” said Ted Mortenson of Baird.

The rapid adoption of generative artificial intelligence is shaking up one of Wall Street's most successful technology companies of the past decade.

Software stocks, known for their high profit margins and asset-light business models, have consistently outperformed asset-heavy, low-profit hardware stocks since 2014.

The NYSE Arca Computer Hardware Index has risen 312% over the past decade, while the Dow Jones US Software Index has risen 576% over the same period.

But that dynamic has shifted this year as companies compete to buy AI-enabled GPU chips from hardware providers including Nvidia, AMD, Super Micro Computer, Broadcom and Dell.

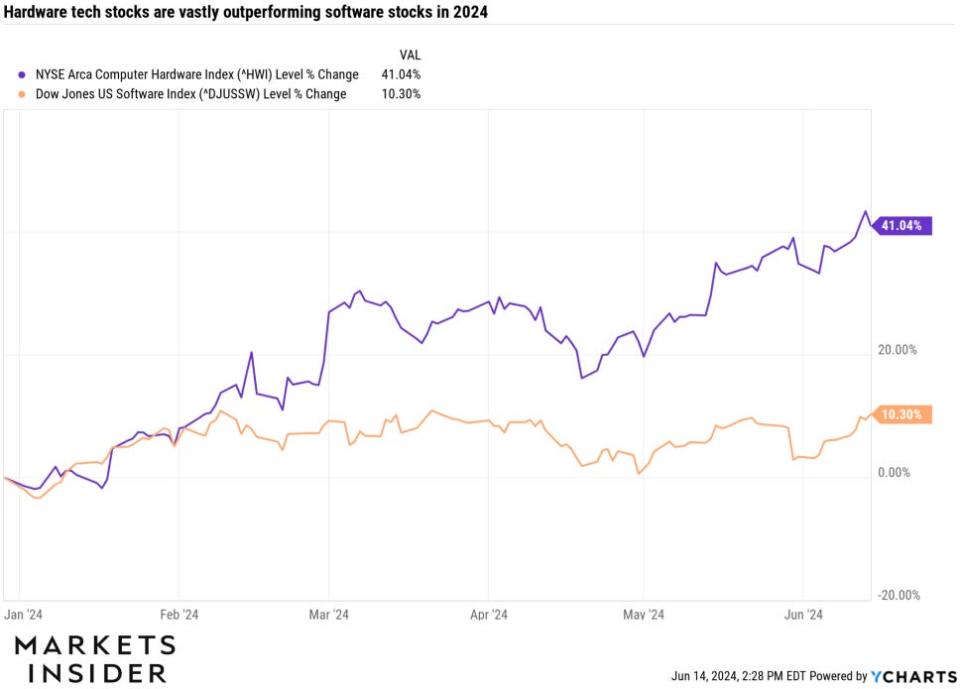

Year to date, hardware technology stocks have outperformed software technology stocks by 30 percentage points.

YCharts/Business Insider

Software stocks including MongoDB, Salesforce, Snowflake and Workday have plummeted this year as earnings results failed to convince investors that AI benefits are on the horizon.

Monetizing AI as a software company is hard

The move reflects the fact that software companies are struggling to make money on AI while hardware companies are enjoying strong business, according to Ted Mortenson, managing director and technology strategist at Baird.

“This GenAI cycle is about infrastructure, everything is about infrastructure,” Mortenson told Business Insider this week. “The cloud giants are spending $200 billion on data centers this year, which is a 50% increase. That's the horsepower, the engine, of GenAI.”

Mortenson said that while hundreds of billions of dollars are being spent on expensive GPUs to develop large language models, few applications offer a significant return on investment for software companies and their customers.

The story continues

“Thirty percent of the Fortune 500 are moving to the cloud. 10% of those are Gen AI enabled. So there's still a long way to go with software and an acceptable return on investment. That's why you don't see it with software. There's no return on investment because there's no application. So you're building the car and the engine, but the software has no passengers,” Mortenson said.

Mortenson explained that one of the main challenges for companies to effectively leverage generative AI technology is that data needs to be organized and structured in a format that Gen AI can understand.

The process could take at least 15 months, and according to Mortenson's recent conversations with software-focused technology executives, few have even begun it yet.

“That's not going to happen until late 2025, 2026. It's not going to happen. It doesn't make any sense,” Mortenson said.

IT budgets are tight

Software companies are also dealing with tight IT budgets as customers shift spending priorities from software to GPU hardware.

“Leading companies recognize that AI is a 'must get it right' proposition, and as a result, they are now beginning to focus on semiconductors and hardware spending at the expense of software spending, and we expect this trend to continue for the foreseeable future,” Larry Tentarelli, strategist at Blue Chip Daily, told Business Insider.

“IT budgets are so tight right now, everyone is scrutinizing the SaaS side, every seat at the table,” Mortenson said.

This trend means hardware stocks will continue to outperform software stocks through 2025, according to Mortenson.

“We're in the middle of a mini-hype cycle, and that's the bottom line: Until we align our infrastructure, reduce costs, and design our applications to work with this next-generation architecture, until that happens and the data gets migrated, enterprise software GenAI isn't going to happen,” Mortenson said. “With the GenAI software, it's backwards. There are no applications.”

Steve Eisman of “The Big Short” fame told CNBC this week that he expects hardware stocks to continue to outperform software stocks.

“The walls that some, not all, software companies have built around their businesses are not going to be as strong,” Eisman said. “We're going to continue to see a re-evaluation of hardware and you could make the argument that some of the software will go off the rails.”

Read the original article on Business Insider