tbralnina/iStock via Getty Images

opportunity

The war has cast a shadow over the stock price of G. Willi-Food International Ltd (NASDAQ:WILC). However, the war also represents an opportunity for investors. We maintain our previous buy rating and would consider replenishing our holdings if the stock price falls below $9 per share.

The stock is down 7.38% so far this year as fighting in Gaza drags on and the war on the northern front intensifies. But shares are up 14% to $9.47 from Black Sabbath's low of $8.12 on October 7, 2023. The stock recovered to $11.34 in January 2024. While it's hard to compare a relatively small company selling to a market of 9 million people to publicly traded U.S. companies, Willie Foods' price-to-earnings ratio of 12.26 makes the stock cheap compared with the current average price-to-earnings ratio of about 26 for food wholesalers.

Willi-Food imports kosher food into Israel and the West Bank from over 150 suppliers. The company sells fresh produce and pre-packaged goods through retail supermarkets, neighborhood grocers, and distributors. Zwi and Joseph Williger and their investment firm hold the controlling interest. The downside is that Willi-Food perceives itself as a family business, rather than a professionally run company that cares about shareholders above all else. Insiders own 72.74% of the stock. There is little public information or regular business updates from management. Increased transparency may be attractive to investors, but shareholder value is not declining.

The positive is that the key people running the company don't seem to be tied down by committees or overbearing outsiders, and they don't take the time to adjust their decisions to take into account rapidly changing circumstances. This is a big benefit to shareholders, and we believe it helps them not to underestimate the ability of management to adapt and generate profits.

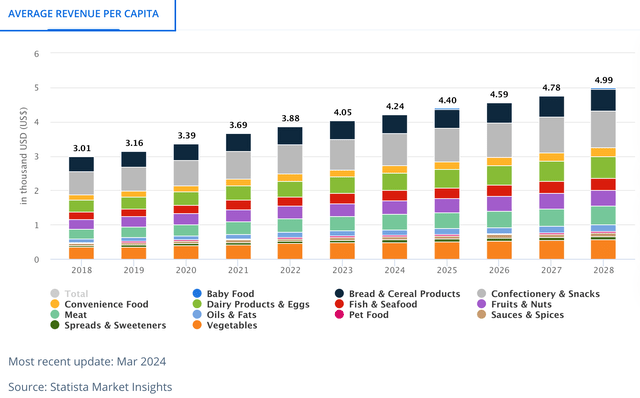

Statista Market Insights predicts that the average amount Israelis spend on groceries (including most types of willi food imports) will continue to grow.

Average income expenditure by food consumers in Israel (Statista)

The first quarter 2024 financial report, released in May 2024, was a bleak picture showing the impact of the Iron Sword War on the company's sales and costs. The company reported a record 9% increase in revenue for fiscal 2023. The impact of the war was significant. Goods from the Far East were delayed due to military attacks on ships, container shortages, and rising shipping costs, reducing operating profits. The ban on commodity exports to Israel from major agricultural and processed food suppliers, including Turkey, Israel's third-largest foreign supplier, weighed on inventories and led to food inflation.

Finance and Valuation

According to Willi-Food, for the first quarter of fiscal 2024, ending March 31, it looks like this:

• Revenues decreased 10.1% to NIS 136 million (US$37 million) from NIS 151.4 million (US$41.1 million) in the first quarter of 2023.

• Gross profit decreased 13.5% year-over-year to NIS 34.7 million (US$ 9.4 million).

• Operating profit decreased 10.7% year-on-year to NIS 11.6 million (US$3.2 million).

• Basic earnings per share were NIS 1.34 (US$0.36).

• Cash and marketable securities balance as of March 31, 2024 was NIS 244.4 million (US$ 66.4 million).

Management responded quickly and made changes in Q1 in response to threatening events. Cost of sales was reduced by 10% compared to Q1 '23. Operating expenses decreased from $7.33 million to $6.25 million for the year. Total financial income surged from $1.43 million at the end of Q1 '23 to $3.1 million in Q1 '24. Basic/Diluted EPS was $0.36 in Q1 '24 compared to $0.21 in Q1 '23.

Profit from continuing operations was reported to have increased to $5.0 million at the end of the first quarter of 2024 from $2.94 million in the first quarter of 2023. Cash and cash equivalents increased slightly to $36.6 million from $35.7 million a year ago. The company spent approximately $1.85 million on real estate and construction of a new distribution facility in 2023 and 2024, which will expand the company's inventory capacity and reduce distribution costs in 2025. Management has not provided an update on the progress of the facility, so it is unclear when the financial impact will begin.

In December 2022, the company boasted a market cap of about $150 million. The stock price hovered around $16 per share. Annual revenue was $141.7 million, with a GP of 40.7%. In June 2024, the market cap was $130.77 million, with a GP of 31.2% TTM. Management did not provide guidance for fiscal 2024 in its announcement at the end of March, which dampened our enthusiasm but did not extinguish it. The current P/E is 12.26 times last year's EPS of $0.63, and the fair value is $7.72. Seeking Alpha's 12.26 times $0.77 per share (TTM) equates to a fair value of $9.44.

Two other positive factors to consider are that the company announced its intention to repurchase 5 million shares in 2023. The other is that one individual purchased 12,700 shares in the past 3-6 months.

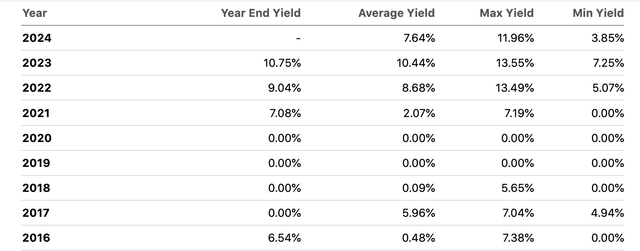

dividend

The current dividend yield is 4.12%. The average over the past four years is 5.91%, with the consumer staples sector median at 2.4%. In terms of earnings yield, Willy Foods is above the sector median. In terms of operating earnings yield, the company (TTM) is at 3.9% versus 8.32%, which I believe is due to the first quarter performance.

The dividend is well covered by free cash flow (TTM). Willy Foods doesn't have a long history of consistency in dividend payments and yields. Management expects to continue the current dividend rate through the year. The dividend payout ratio is just 63%.

Annual dividend rate (Seeking Alpha)

risk

Investors should consider the increased risks that could cause share prices to fall.

The biggest risk is the outbreak of a broader war in the Middle East, which would further disrupt shipping and foreign investment. Israeli food price inflation remains in the 3% range. Consumers are selective in their food purchases, focusing on essentials; if they don't eat today, they'll eat tomorrow. We don't expect sales to decline much further. Government policies, high taxes, and external business interruptions have had a significant impact on G. Willy Foods' stock price. Management did not mention the status of share repurchases in the Q1 statement. There has been no guidance on sales and profit growth from management in the past two quarterly reports. This lack of transparency and poor information flow is discouraging investment. Although sales increased in 2023, gross margins and profits declined, with the decline accelerating in Q1 2024. EPS growth is currently at -5.7%.

remove

Three years ago, the stock hit $25 a share. In our view, as long as tensions persist, the stock will remain in the $9 to $10 range. If the war ends sooner than expected, peace returns to the North, reservists return to normal life, and the boycott and shipping costs are fixed, the stock could rise to a 52-week high of $13 a share.

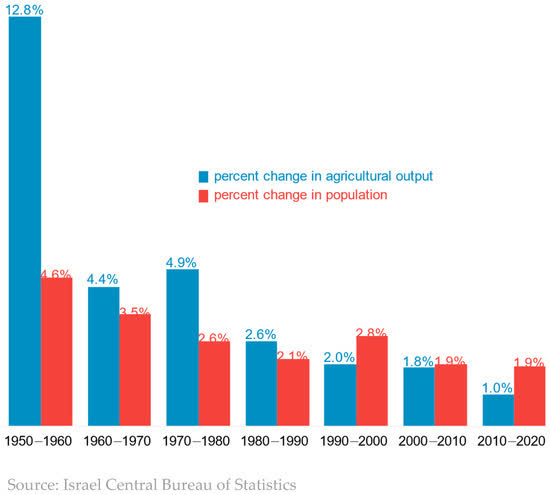

As Israel's population grows and the country urbanizes, it will need to import more food. Israel currently imports over 50% of its agricultural and processed foods. Climate change, which is increasing temperatures and decreasing precipitation across the Middle East, is increasing the need for imported food. Import rates are expected to continue to increase in the future, which bodes well for importers.

Agricultural land and population growth (Israel CBS-mdpi)

G. Willi-Food is making capital investments to increase efficiency and reduce costs. If peace prevails, the future will be bright for investors in G. Willi-Food. If peace prevails and people can continue to thrive, the stock price could rise in the $9 range, creating a buying opportunity.