Skift Take

Travel venture capital hit a 10-year low of $2.9 billion in 2023, but shows signs of recovery in early 2024 due to increased investment from Asia and the Middle East and a focus on experience and AI.

Pranavi Agarwal

A new report from Skift Research examines the current state of venture capital investment in the travel industry. Here are five key insights and takeaways:

Insight 1: Venture capital investment in the travel industry has fallen to its lowest level in a decade.

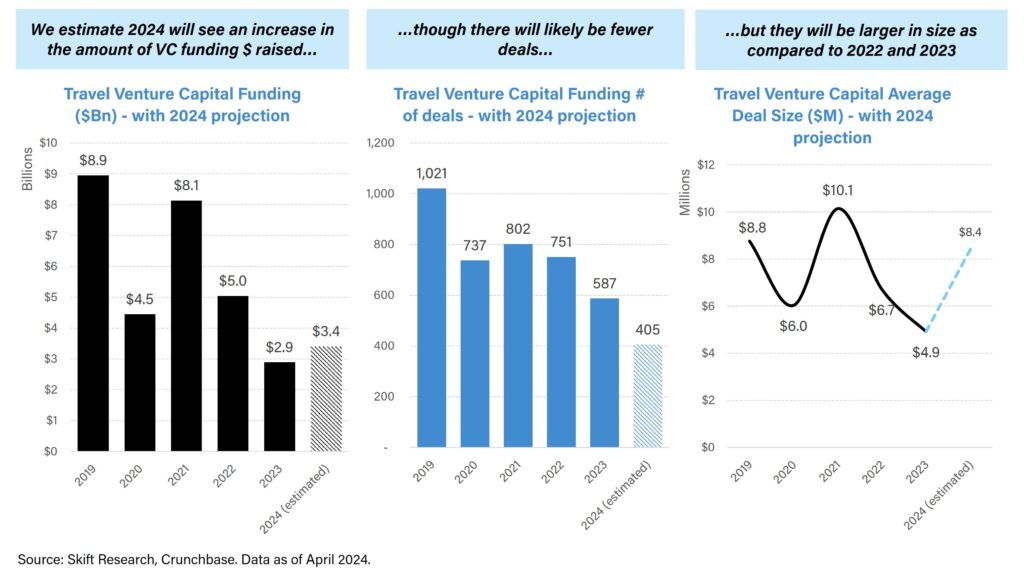

Venture capital (VC) investment in the travel sector is expected to reach just $2.9 billion in 2023, the lowest level in a decade, compared to $5 billion in 2022 and nearly $9 billion in 2019.

The number of deals has also fallen significantly, dropping from 1,021 in 2019 to just 587 in 2023. The number of deals in 2023 is down more than 20% compared to 2022, which is the second steepest drop since the 2020 lockdown.

The decline in travel investment coincides with an overall decline in venture capital, which continues to struggle amid a tough macroeconomic environment characterized by rising interest rates and falling valuations.

In 2020 and 2021, travel VCs underperformed the overall VC market. But in 2022 and 2023, both will see similar declines, down roughly 40% each.

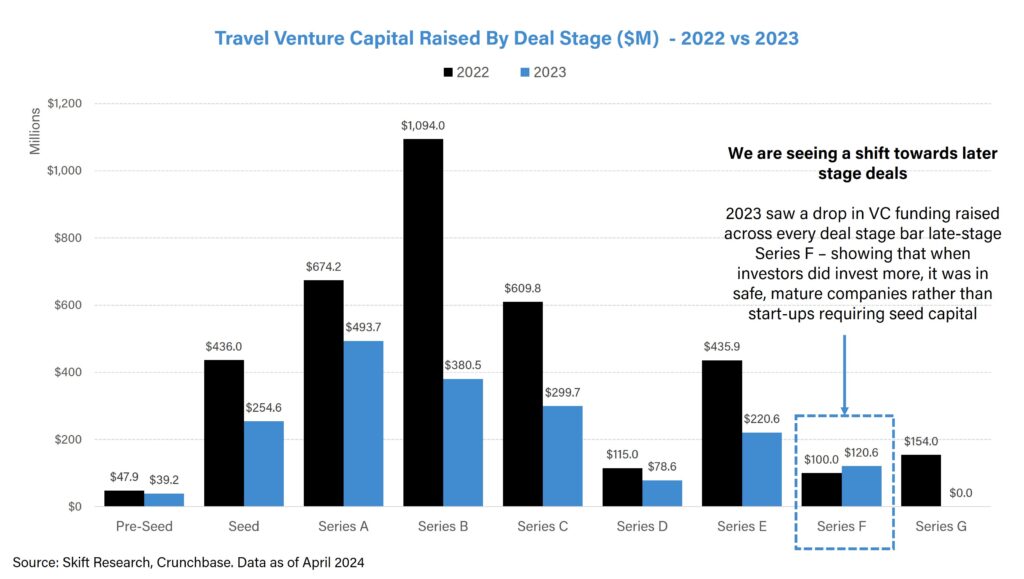

Insight 2. There is a shift toward investing in later-stage, mature companies.

While 2020 and 2021 saw a surge in early-stage (pre-seed or seed capital) VC funding by startups, 2023 has seen a move towards later-stage funding.

For example, last year VC funding declined at all deal stages except late Series F, indicating that investors were investing, if at all, in safe, mature companies.

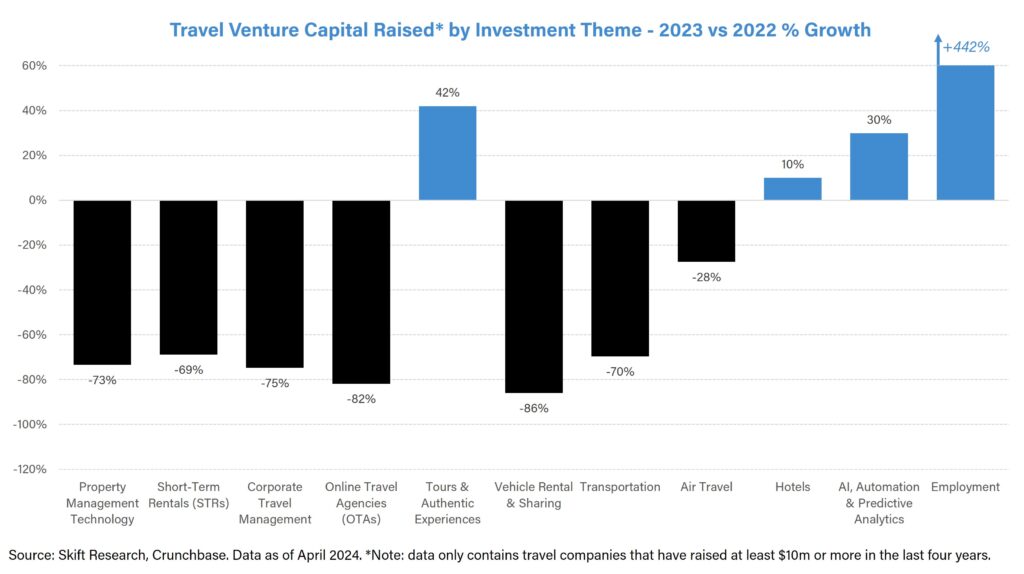

Insight 3. Areas expected to grow: Tours and experiences, AI and automation, hospitality jobs.

There is significant investment in the tours and experiences sector, driven by large funding rounds for OTAs Klook and GetYourGuide. Investors see opportunity and untapped prospects in the tours and experiences sector. The sector is highly fragmented with a long tail of smaller suppliers and is rapidly moving online. Read our in-depth analysis of the experiences sector here: The Last Hub of Travel: A Deep Analysis of Tours, Activities & Experiences in 2023.

Hospitality hiring has also seen a significant increase in venture capital investment, driven primarily by a funding round for on-demand staffing app and recruiting service provider Instawork, which is set to grow from $8 million in 2022 to $60 million in 2023, with its latest Series D round specifically focused on implementing AI and machine learning into its operations.

AI, automation and predictive analytics are another key area of investor interest in 2023. At Skift's 2024 Data & AI Summit, Chris Hemeter, managing director at Thayer Ventures, said there remains a huge opportunity for technological advancements in the travel industry, and that gap could be filled by AI.

“We're in serious trouble right now with an incredible amount of technical debt. [hospitality] “The industry is just piling on technology and trying to keep up, and travelers are changing,” Hemeter said.

But investors aren't just investing “for AI's sake,” says Kurian Jacob of Highgate Technology Ventures.

“We're not looking for AI companies in the travel industry, you're not taking that approach,” he says, but rather “we're looking for companies that can best leverage AI.”

According to Thayer Ventures' Hemmeter, “every blue-chip company will have some sort of AI tool built into their value proposition.”

Instead of investing in AI companies alone, investors are increasingly looking for companies that can effectively implement AI into their technology stack and strategy. To learn more, read our in-depth analysis on AI in travel, “The Impact of Generative AI in Travel.”

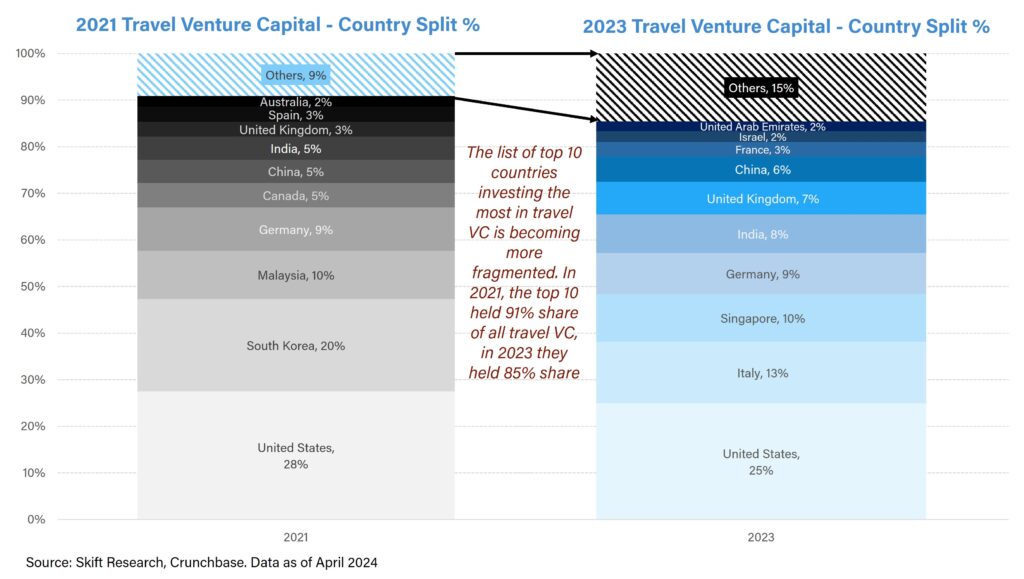

Insight 4. The list of the top 10 countries investing in travel venture capital shows increasing fragmentation and a shift eastwards.

In 2021, the top 10 countries will account for 91% share of the travel venture capital market, and 85% in 2023.

The United States remains the largest country for travel VC investment, accounting for $722 million (25% of the global total) in 2023. However, there is an increasingly noticeable shift eastward, with Singapore and India taking third and fifth places respectively. India moved up from seventh place in 2021.

Insight 5. 2024 is expected to see an increase in VC funding in the travel sector.

Based on preliminary data for Q1 2024, we expect investors to continue to be very selective in their investments, in line with a continuing shift towards investing in larger, later-stage mature companies.

Compared to 2023, we expect the number of deals to decrease but their average size to tend to be larger.

This should lead to an overall increase in travel-related VC funding in 2024. For example, at least 10 companies (including Travelperk, Mews, and Guesty) have already raised over $100 million in venture capital funding so far this year.

Additionally, we expect VC deal flow to improve further as the interest rate environment improves through 2025 and 2026. We find a strong inverse correlation between US interest rates and the amount of VC funding into the US travel industry. Our analysis shows that every 0.1% decrease in US interest rates could increase VC investment in US travel companies by approximately $50 million.

Read the full report for methodology and detailed analysis of the travel venture capital market by region, company and sector.

What you can learn from this report

Read the full report for methodology and detailed analysis of the travel venture capital market by region, company and sector.

Travel startup funding market size from 2009 to 2023 and forecast to 2024 Funding in 2023 by deal stage, region, company, and sector Key funding trends in travel startups in 2023: Tours & Experiences, Corporate Travel & Expense Management, Property Management Technology, Short-Term Rentals, OTAs, AI Automation & Predictive Analytics, and Other thematic buckets

This is the latest in a series of research reports, analyst sessions and data sheets aimed at analyzing the drivers of travel disruption. These reports are aimed at busy travel industry decision makers. Benefit from the opinions and insights of our experienced staff and contributors. Each report represents over 200 hours of desk research, data collection and/or analysis.

Subscribe to the Skift research report now

Once you register, you will have access to all the reports, analyst sessions and data sheets conducted on topics ranging from technology to marketing strategies to in-depth analysis of leading travel brands. The reports are available online in a responsive design format or you can purchase each report individually for a larger fee.

Photo credit: Unsplash/ Image shows unicorn piggy banks representing tour and experience operators Klook and GetYourGuide. Both are privately held companies valued at over $1 billion, achieving unicorn status. Klook and GetYourGuide were the top two most funded travel companies in 2023.