Even as consumers tighten their budgets on certain discretionary expenses like dining out and luxury items, interest in travel remains high. This has led to surprisingly stable spending on vacations and travel, and subsequent unexpected stability in travel stocks. For investors looking for travel stocks to buy now, there are ample opportunities to grow wealth through this sector.

93% of travelers say they have travel plans in the next six months, and total U.S. trips, both domestic and international, are expected to return to pre-pandemic levels by the second half of 2024. Travel spending is expected to grow annually and reach $1.22 trillion by 2027. With interest in travel remaining high, these three travel stocks look promising. These companies are using technology to cut expenses and create new avenues to generate revenue.

Viking Holdings (VIK)

Image source: StudioPortoSabbia / Shutterstock.com

Viking Holdings (NYSE:VIK), the parent company of the Viking River Cruises brand, only held its initial public offering (IPO) last month. Since then, the company's shares have already risen 8%. However, the company has been in business since 1997, and its popularity and brand recognition have only grown over the years.

Once thought of as an activity primarily for older travelers, river cruises are experiencing a resurgence, with young social media influencers touting the benefits of river travel in Europe and elsewhere: it's convenient and cost-effective, plus it allows passengers to see different cities in the region without having to unpack just once.

To be sure, Viking Holdings is a well-known name in the river cruise industry and one of the few publicly traded river cruise companies, and it's well positioned to benefit from this growing popularity and continued spending on travel. VIK plans to complete 10 new ships between now and 2026, as well as expand into land tours and safaris. This presents an opportunity for Viking Holdings to capitalize on the luxury vacation market.

The company's next earnings report isn't due to be released until July 24th, so VIK is a great travel stock pick to buy now as you can invest before the quarterly update is signed.

Booking Holdings (BKNG)

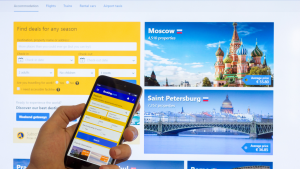

Credit: Andrey Solov'ev / Shutterstock

Booking Holdings (NASDAQ:BKNG) owns a vast network of subsidiary brands, including Priceline, Booking.com, Agoda, KAYAK and OpenTable. As the world's largest DIY travel agency, the company operates in more than 220 countries and territories. Through its websites, travelers can book flights, hotels, car rentals, restaurants and experiences.

Q1 2024 results were promising for Booking Holdings. Travelers booked more than 300 million nights in the first quarter, up 9% year over year and beating management's expectations. Revenue was $4.4 billion, up 17% year over year, and adjusted EBITDA was up 53% to $900 million. Earnings per share (EPS) also increased 76% year over year. The company's Chief Financial Officer (CFO), Ewaut Steenburgen, warned that room night growth may slow in the second quarter. However, Q1 results highlight Booking Holdings' ability to continue growing rapidly even during times of broader economic slowdown.

The company is also leveraging artificial intelligence (AI) software to improve its customer-facing tools, aiming to reduce agent contact rates and increase bookings. By lowering customer service costs per transaction and increasing revenue through increased bookings, Booking Holdings has a solid strategy for the future.

US Global Jets ETF (JETS)

Image credit: frank_peters / Shutterstock.com

The US Global Jets ETF (NYSEARCA:JETS) is an exchange-traded fund (ETF) composed of companies representing US and international passenger airlines, aircraft manufacturers, airports, terminal service companies, and aviation-related internet media and services companies. Top holdings include Delta Air Lines (NYSE:DAL), United Airlines (NASDAQ:UAL), and American Airlines (NASDAQ:AAL). Each company represents approximately 11% of the fund. Three-quarters of the portfolio is made up of companies based in the US. The remaining 25% is made up of companies from countries such as Canada, Japan, Mexico, Brazil, and the UK.

Since the pandemic, the airline industry has struggled to bring back customers and maintain profits. Rising fuel costs, labor shortages, contract disputes, and recent negative press surrounding the quality of Boeing's (NYSE:BA) aircraft have all contributed to the downward trend in airline stocks. But for investors looking for travel stocks to buy now, JETS offers a great opportunity to buy on the dip.

JETS is nowhere near its pre-pandemic highs of $32, but analysts have an average price target of $24.28 and are forecasting a 23% upside. Year-to-date (YTD) it's up 5%. It may be a long-term investment, but investing in JETS now while the airline industry is still in trouble could pay off handsomely when the airline industry recovers, which it will.

As of the publication date of this article, Philippa Main held a long position in VIK shares. Opinions expressed in this article are those of the author and follow InvestorPlace.com's publishing guidelines.

Philippa Main is a real estate agent in Virginia and Florida who also does freelance writing, editing, business development, and marketing. She uses her extensive knowledge of the real estate market to inform investment decisions across a variety of industries, and enjoys educating women about finance and investing.