A local video game studio is among the latest businesses to be forced to make large-scale layoffs as enthusiasm for private funding cautiously recovers.

In 2021, many technology companies became bloated due to inflated valuations and unsustainable growth fueled by the tech sector bubble.

More than a dozen British Columbia companies have raised venture capital funding, becoming unicorns (privately held companies valued at more than $1 billion) and several local technology companies have gone public.

And then the bubble burst.

Technology stocks began to plummet in the spring of 2022 as fears of inflation, rising interest rates and a recession led investors to flee to safe havens and forced tech companies to make massive layoffs.

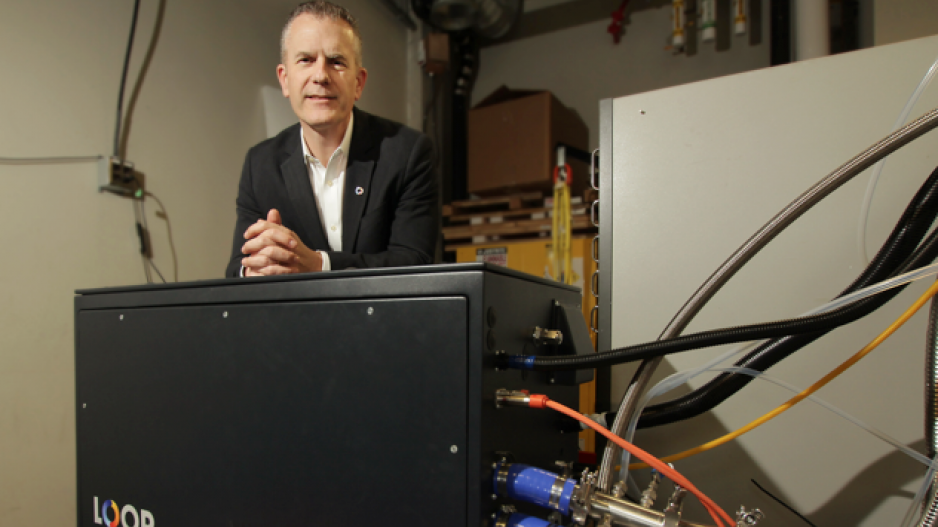

For example, Loop Energy (TSX: LPEN), a Burnaby-based hydrogen fuel cell company, listed on the Toronto Stock Exchange (TSX) at $16.45 per share in 2021. It is now facing the possibility of being delisted.

The company is cutting 65% of its workforce by 2023, and as of last week, its shares were trading below $0.04 per share.

The technology sector's brutal two-year bear market may not be over yet, despite some recent big fundraising and acquisitions that suggest a recovery is on the way.

Brent Holliday, CEO of Garibaldi Capital Advisors, said he believes 2024 will be a year of “cleansing” and “fire sales” that will result in a shakeout of tech startups.

“This is a great technology cleansing year and we're going to see fewer companies and fewer jobs, but in markets that are starting to grow again, there are fewer companies,” he said.

“I've been through the dot-com bubble and bust, the 2007-2008 economic downturn and now this one,” said Rob Gehring, CEO of Wisr AI. “This one's bad.

“Nobody I'm close to has ever been in a situation where they had to shut down their company, or go into low-growth stagnation mode and weather it, or take on hard VC funding to survive.”

“The tech industry has been in a long boom period, it was hit by COVID, and then it's fallen off probably more than other industries,” said Maria Pacella, managing partner at Penderfund Ventures, an early investor in Copperleaf Technologies Inc. (TSX:CPLF). In what has been a very dark period for tech fundraising, Copperleaf Technologies is one of the few bright spots.

International enterprise software giant IFS' $1 billion investment in Vancouver-based Copperleaf and a $104 million private funding round for Vancouver medical device company Kardium are raising hopes that the bear market in B.C.'s tech sector may soon be over.

“I think there's some cautious optimism,” Pacella said. “I think there's still uncertainty in the background. I don't know if it's too early to say things have turned around, but I'm certainly more optimistic than I was in 2023.”

CopperLeaf is one of a handful of Vancouver companies to go public in 2021.

When it listed on the TSX, Copperleaf's shares would have traded at $24.70, giving it a market capitalization of $1.8 billion. That price shows just how overheated the tech market has been in 2021.

“Something crazy was happening,” Holliday said. “Companies were raising $100 million and only had $4 million in revenue. It was crazy. The bubble was going to pop at some point.”

Copperleaf's stock price fell to $3.60 per share in October 2022.

The company's stock price rose to $11.87 per share last week, giving it a market capitalization of about $881 million. IFS's $1 billion acquisition offer represents an 18% premium over the stock's price on June 10 and a 70% premium over its price on May 3, just before the offer was made.

“Copperleaf went public for the right reasons. It's always been a quality company and had proven it could be profitable before going public, but it was investing for growth,” Pacella said.

A rise in the tech stock index in 2024 could signal the end of the tech bear market, and that could be true for large companies and those in the AI space.

But in the civilian market it's a completely different story.

“What's happening in the public and private markets is very different,” Holliday said.

When the 2022 correction occurred, tech companies were told to try to raise capital for 18 to 20 months, the thinking being that that would be enough money to wait until inflation and high interest rates subsided, Holliday said.

“Well, inflation is a little bit higher. [of] “It was nastier, it was stickier,” Holliday said.

As a result, many tech startups have run out of funding and many have had to resort to laying off staff. The tech job market in parts of British Columbia remains sluggish, especially for video game studios.

For example, on June 11, UK-based Sumo Group announced it would lay off 15% of its global workforce, including closing its Timbre Games in Vancouver.

“We're not seeing any major layoffs this year,” said Stephanie Hollingshead, CEO of tech-focused recruiting firm TAP Network, “Instead, most companies are finding other ways to cut costs and are operating on fairly tight budgets.”

Hollingshead said the layoffs have been concentrated in the gaming industry, with companies such as Burnaby-based Phoenix Labs and Vancouver-based A Thinking Ape having carried out some fairly large layoffs recently.

“Two years ago, our survey found that nearly 90% of technology companies expected to grow their employee headcount over the next two years,” she said. “We asked them again this spring, and this time only half of companies said they expected to grow their employee headcount over the next two years.”

Not all tech companies are struggling.

Thinkific Labs Inc. (TSX:THNC), a platform that allows businesses and educators to develop online courses and tutorials, was one of B.C.'s unicorns to go public in the spring of 2021, raising $160 million in an initial public offering. Nearly a year later, the company has laid off 20 per cent of its workforce.

The company turned things around in the fourth quarter of 2023, reporting a small net profit for the first time since going public in 2021. It's also been rehiring, and its shares have recovered to around $3.70 per share since hitting a bottom of $1.40 per share in December 2022.

“Obviously the tech market as a whole downturn in '21 hurt everyone, but looking back over the last 24 months, we've had a much stronger run,” ThinkFic CEO Greg Smith said.

Going forward, artificial intelligence companies are expected to provide impetus to the technology sector.

“This is going to be a huge wave that will underpin the next technology cycle,” Smith said.

[email protected]