Investing.com — Most Asian stocks fell on Thursday as technology shares followed U.S. stocks lower after semiconductor giant Micron's disappointing earnings outlook.

Chinese shares continued to fall as weak industrial profits data further soured sentiment towards China, while traders await further developments in a potential trade war with the West.

Regional markets received middling readings from Wall Street, which ended modestly higher in choppy trading, but U.S. stock index futures fell on Thursday as investors sold semiconductor shares after Micron Technology Inc. (NASDAQ:) reported a middling earnings outlook.

Expectations for key US indicators such as economic data and the presidential debate also contributed to volatility in sentiment.

Micron's disappointment sinks Asian tech, chipmakers

Tech-heavy Asian bourses were the region's worst performers on Thursday, with Japan down 1.2 percent and South Korea down 0.5 percent.

Weakness in tech stocks combined with worries about China led Hong Kong's stock index to fall 1.7%.

While Micron's quarterly profit beat expectations, the company's current-quarter revenue guidance disappointed investors who were hoping for even greater gains, given that its stock price has soared more than 100% since last year. Micron's shares fell about 8% in after-hours trading.

The disappointing guidance raised doubts about a surge in demand from artificial intelligence and also prompted investors to take some of the recent gains in tech stocks.

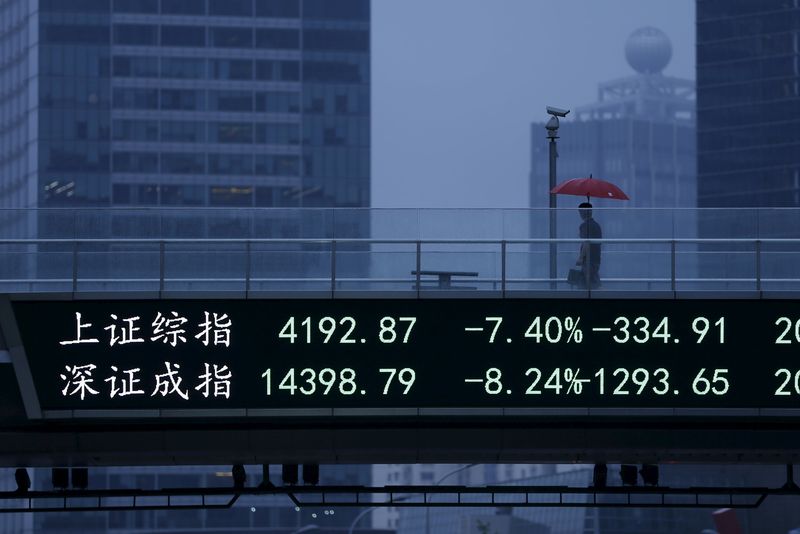

China stocks fall on weak industrial profits data

In China, GDP and the stock index fell 0.7% and 0.9% respectively as data showed the country's economic growth contracted in May.

The figures reinforced concerns that economic growth in Asia's largest economy is slowing and that the Chinese government may have to implement further stimulus measures to boost growth in coming months.

The Chinese Communist Party is due to hold its Third Plenary Session, a key high-level meeting, in July where it is likely to announce further economic aid.

But it faces a potential trade war with Western countries after the European Union joined the United States in imposing import tariffs on Chinese electric vehicles, and sentiment toward China remains already weak.

Asian markets were broadly negative. Australia fell 1%, extending its sharp decline from the previous day's trading, as higher than expected inflation numbers raised concerns about a possible interest rate hike by the Reserve Bank of Australia.

Indian stock index futures are expected to take a breather after hitting consecutive record highs this week, suggesting a subdued start to the day.