Fabrizio Frieda, president and CEO of The Estée Lauder Companies, said the recovery in the U.S. beauty company's North Asia travel retail business is driving net sales for the fiscal year ended March 2018 to be up 5% year over year. The company hailed it as the key to increasing organic sales (+6%) to USD 3.94 billion. The third quarter he finished on March 31st.

As reported, ELC's third quarter growth in Asia Pacific travel retail was driven by stronger sales and This was driven by increased shipment volumes as retail inventory levels improved. [i.e. Daigou -Ed] Market activities in Hainan Island and South Korea.

Frieda said this in a post-earnings conference this week. We are encouraged by the evolution of Asia's travel retail business this year, with the priority of working with retailers to reduce trade inventories and the implementation of anti-unstructured initiatives by various local governments. I am. [i.e. daigou -Ed] market activity.

(Above) Brands from The Estée Lauder Companies' portfolio occupy prime positions at the China Duty Free Group's store at Haikou Meilan International Airport Terminal 1, and the above message attracts more than 100,000 RMB annually to Chinese shoppers. Reminds me of the offshore duty free allowance of yuan (US$1,380). (Bottom) A sign of the times: Official warnings about resale penalties, in Chinese and English, are displayed prominently next to the retailer's vast offshore duty-free land, primarily in domestic terminals (Photo: Martin Moodie, April 2024)

(Above) Brands from The Estée Lauder Companies' portfolio occupy prime positions at the China Duty Free Group's store at Haikou Meilan International Airport Terminal 1, and the above message attracts more than 100,000 RMB annually to Chinese shoppers. Reminds me of the offshore duty free allowance of yuan (US$1,380). (Bottom) A sign of the times: Official warnings about resale penalties, in Chinese and English, are displayed prominently next to the retailer's vast offshore duty-free land, primarily in domestic terminals (Photo: Martin Moodie, April 2024)

“Retail sales growth in Asia travel retail improved significantly from the previous quarter and returned to growth in the third quarter. This improving sales trend in travel retail in Asia is similar to that in EMEA and the Americas. Complementing the double-digit retail sales growth we continue to see in travel retail.

“This year so far, we have seen long-term growth opportunities for travel consumers, as evidenced by the relocation of our brands to Hainan City and the relocation of CDF Sanya International Duty Free Store to the new Global Beauty Plaza. has also invested.

“The larger, more elegant new store complements the complex's previous stores, with everything from Estée Lauder ReNutriv's new Skin Longevity Institute to La Mer Cabin, offering bespoke spa services and Kilian Paris Juices. We've expanded on our high-touch service and experience with a cocktail bar serving aroma-inspired cocktails.

(Top and Bottom) Improved travel retail performance led La Mer to double-digit global net sales growth in the third quarter. Pictured is La Mer's flagship boutique at Global Beauty Plaza, CDF Sanya International Duty Free Shopping Complex in Haitang Bay, Hainan Province {Photo: Hannah Tan-Gillies, April 2024}.

(Top and Bottom) Improved travel retail performance led La Mer to double-digit global net sales growth in the third quarter. Pictured is La Mer's flagship boutique at Global Beauty Plaza, CDF Sanya International Duty Free Shopping Complex in Haitang Bay, Hainan Province {Photo: Hannah Tan-Gillies, April 2024}.

Tracy Travis, Executive Vice President and Chief Financial Officer, added: These results for the quarter were a little earlier than expected, resulting in a partial change in the expected resumption of replenishment orders from the fourth quarter to the third quarter. ”

He said that growth was partially offset by lower-than-expected net sales in mainland China. This is partly due to weak consumer confidence and softening during holidays and key shopping periods, and reflects a continued softening in overall luxury aesthetics. Travis explained.

Travel Retail's performance was the main driver of the +12% year-on-year increase in organic net sales in the Europe, Middle East and Africa region (of which Global Travel Retail is a part).

“Our travel retail net sales increased significantly by double digits, reflecting sequential acceleration in retail sales and shipment volumes, as well as a decline in shipments last year weighed down by temporary headwinds in Hainan. , which returned to growth after seven consecutive quarters of decline. Last year also saw restrictions on international flights, visas, and group tours from China to other markets,” Travis commented.

Strong performance in Hong Kong and mainland China, along with a recovery in travel retail, drove a +9% year-over-year increase in key skin care categories.

Lower inventory levels improve outlook

Mr. Travis said the company is pleased with the progress it has made in reducing inventory levels in travel retail in Asia. This has prompted the resumption of replenishment shipments within the channel, accelerated innovation and selectively expanded the group's consumer reach, she noted.

“These efforts have resulted in continuous improvement in both net sales and operating margins since the first half of this year, and returned net sales to positive growth in the current quarter,” she commented.

However, Mr. Travis added the following caution: “Asia Travel Retail also notes that retail sales may fluctuate in the short term related to actions some retailers are taking to increase profitability.” [by increasing retail prices in China -Ed.”

In the question and answer session, Freda added: “Global travel retail returned to growth driven by retail growth across all the regions… retail sales growth was very, very strong in EMEA, Americas, in many parts of APAC, and was single-digit in China TR,

“This is a very important progress versus the past and this for The Estée Lauder Companies brands is great news also for the future. The second thing that we are seeing is a very robust traffic recovery across the travel retail channel, which is driving sales to travellers.

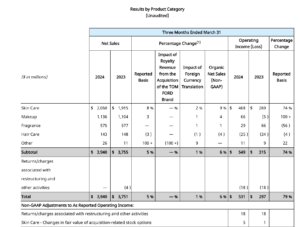

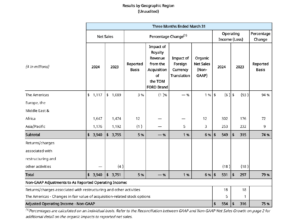

Travel retail is key to all categories but particularly so for skincare in Asia. Click on tables to expand.

Travel retail is key to all categories but particularly so for skincare in Asia. Click on tables to expand.

“There is work to be done still on conversion, which is the area of improvement that we are still working on. But we had a lot of work in progress in this via retail activations – particularly in Hainan with a lot of activity. And these activations are working, and so we see progress also in this area.

“And then… because of all these elements, [we are seeing] Target achievement for some retailers and some SKUs exceeded regionally published targets as retailer inventories improved significantly. So…this has led to very good growth based on retail growth and sales replenishment as inventory levels have decreased compared to the past. This combination is very strong and we look forward to it continuing and progressing in line with our goals. ”

Regarding the broader Chinese market (all channels), Frieda said: “At the moment, the whole prestige market is slowing and softening. It's softer than we originally expected, and that's why it's stuck in mainland China.”

He continued: “We look at Chinese consumers holistically, not just by segmentation. So we have mainland Chinese consumers and Chinese consumers from the Hong Kong Special Administrative Region, which includes Hainan province, for example. And we have Chinese consumers who travel abroad. Consumers, some people travel from China to places like Tokyo and Paris for tourism and business, so overall Chinese consumer consumption of our brands is really progressing and that trend is very strong.”

Frieda said the group is encouraged by the return of Chinese tourists to destinations such as Japan and Paris. He said there had been “clear progress” between the second and third quarters despite mainland weakness, and the outlook for the fourth quarter was “very interestingly positive.”

Frida welcomes the move to a more structured market

Frida welcomes the move to a more structured market

Chinese consumer trends vary by channel. Travel retailer Frida has benefited from more luxury-oriented consumers, but the main market weakness is related to China's domestic middle class.

Strengthening sell-through in the fourth quarter

Frieda said the expected further rebalancing of China's structured and unstructured markets is consistent with the company's goals and is aimed at. “That means there are positive long-term trends taking place,” he said.

“Be sure to understand that despite short-term weakness in the mainland Chinese market, overall trends among Chinese consumers are positive, and this trend is expected to accelerate in the future,” he said. I want to,” he added.

Travis commented on the return to satisfactory inventory levels sooner than expected, which accelerated replenishment rates. [inventory] It's a little earlier level than we expected.

“We expected to be able to reach them by April, the beginning of the fourth quarter, but we were able to reach them within the third quarter.

“This is why some shipments were a little higher in Q3, and we should expect to see strong retail sales in Q4.” ✈