Tech stocks were looking to build on last week's solid end, creeping higher early Monday.

Nasdaq 100 futures rose 0.1% in early trading after the tech-heavy Nasdaq Composite Index rose 2% on Friday, securing its second consecutive week of gains.

Palantir shares rose 2.4% after the close ahead of the data analytics software company's first quarter results. Investors will be keen to watch for updates on Palantir's artificial intelligence push and progress.

Apple stock (down 1.1% in pre-market trading) will also be in the spotlight, especially after Warren Buffett revealed that Berkshire Hathaway has further pared back its stake in the tech giant. But Buffett reiterated his commitment to Apple, saying it would likely still be Berkshire's largest holding by the end of the year.

In a further positive sign for Apple, Foxconn, the largest iPhone assembler, reported record sales in April and said on Sunday that it still expected second-quarter sales to increase.

Advertisement – SCROLL TO CONTINUE

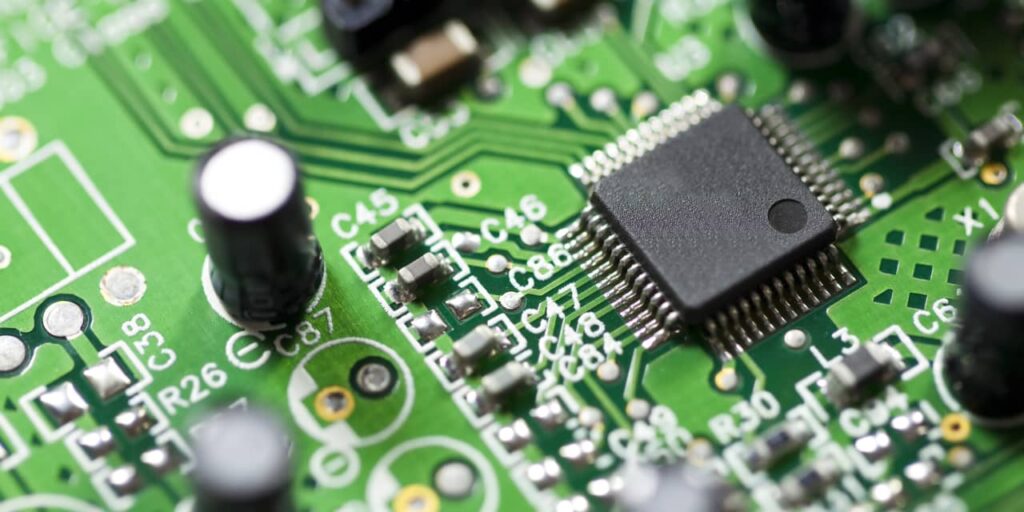

The chip sector appears to be off to a strong start to the week, with Nvidia up 0.7%, Advanced Micro Devices up 1.5% and Micron Technology up 2.1% in pre-market trading. Intel shares rose 0.7%.

Magnificent 7 stock prices were more mixed than before, with Alphabet falling, Amazon flat, and Microsoft rising slightly. However, there were significant gains for Tesla and Metaplatform, with both stocks up about 1%.

Cryptocurrency stocks soared in early trading as Bitcoin continues to rally. The price of the world's largest digital asset was above $65,400 on Monday and had been trading below $60,000 until Thursday. The momentum carried over into the weekend, aided by a weaker-than-expected April jobs report.

MicroStrategy shares rose 9% in pre-market trading, Marathon Digital rose 8.4%, Coinbase Global rose 3.7% and Robinhood Markets rose 3.7%.

Advertisement – SCROLL TO CONTINUE

It increased by 2%.

Email Callum Keown at callum.keown@barrons.com.