Big tech is disrupting once again, this time in dividend investing.

Large-cap stocks Alphabet GOOGL/GOOG, Meta Platforms META, and Salesforce CRM have announced their first-ever dividend payments, joining a growing number of small-cap tech stocks.

Although most tech stocks have relatively low yields, the potential for dividends to grow along with earnings over the long term is attractive to many investors who value dividend growth. This is changing the face of dividend growth strategies from the financial industry and other low-growth companies. Tech stocks have risen from 2.3% of the Morningstar U.S. Dividend Growth Index (composed of securities with a history of uninterrupted dividend growth and the ability to sustain that growth) in 2003 to 18.0% by the end of 2023. did.

Market returns in recent years have been driven by big tech companies and broader growth stocks, and this dynamic is trickling down to dividend growth investing. With big tech stocks like Meta and Alphabet issuing dividends, Income Strategies “now has access to and exposure to stocks that have been driving the market in recent years,” says $3.9 billion Franklin Equity.・Matt Quinlan, lead portfolio manager of income fund FISEX, said: the $27.4 billion Franklin Rising Dividends Fund FRDPX;

Tom Huber, portfolio manager at the $24.4 billion T. Rowe Price Dividend Growth Fund PRDGX, thinks there's still room for this trend. “There will be more and more opportunities for dividend growth investors to buy tech stocks,” he says.

There is one potential pitfall for investors. This trend means that dividend growth strategies may capture more of the overall stock market return, but it may also make them less attractive as a portfolio diversifier. “Big name participation [Meta, Alphabet] “Indices across all types of dividend indexes and dividend growth indexes are very likely to be highly correlated with the broader market,” says David Harrell, editor of the Morningstar Dividend Investor Newsletter.

Dividend trends in high-tech stocks

In most cases, technology companies and growth stocks typically do not return the cash they generate to investors through dividends. Instead, that cash is reinvested into the business to fuel further growth or returned to investors through share buybacks. Still, dividend announcements by major tech giants extend a long-term trend.

“I first saw that in semiconductors,” Quinlan says. Texas Instruments TXN issued its first dividend in 1985, Analog Devices ADI made its payment in 2003, and Broadcom AVGO followed suit in 2010. “These companies have attractive financial models that generate significant cash flow,” he explains. “They can both invest in the business and reinvest to maintain their competitive position while still paying dividends.”

The Morningstar U.S. Target Market Exposure Index, which measures the performance of the top 85% of U.S. stocks by market capitalization, has also seen a modest influx of high-dividend tech stocks. In 2008, 22 stocks in the index paid dividends in tech stocks. By 2015, that number had increased to 41 companies, and by the end of 2023 it was 47 companies.

As of April 30, 2024, the 10 high-dividend tech stocks with the largest weights in the Morningstar US Target Market Exposure Index are:

Microsoft MSFTApple AAPLNvidia NVDAAlphabet GOOGL/GOOG Meta Platform METABroadcom AVGOSalesforce CRMCisco Systems CSCOAccenture ACNQualcomm QCOM

Even though the name increases, the dividend yield is low

More tech stocks are paying dividends, but yields are low. The Morningstar US Technology Index has the lowest forward dividend yield of all Morningstar sector indexes at 0.72%. Excluding real estate, the two sectors with the highest yields are utilities at 3.44% and energy at 3.10%.

Huber said low yields are partly due to the mindset of executives at big tech companies. “It takes time for companies to grow and mature and realize that they are generating more cash than they need,” he explains. A dividend is a promise, he points out. “Once you start, you never want to cut corners, and ideally you want to grow.” He added that some companies don't expect continued strong growth by paying dividends. He said he was concerned that it would show that he had not done so.

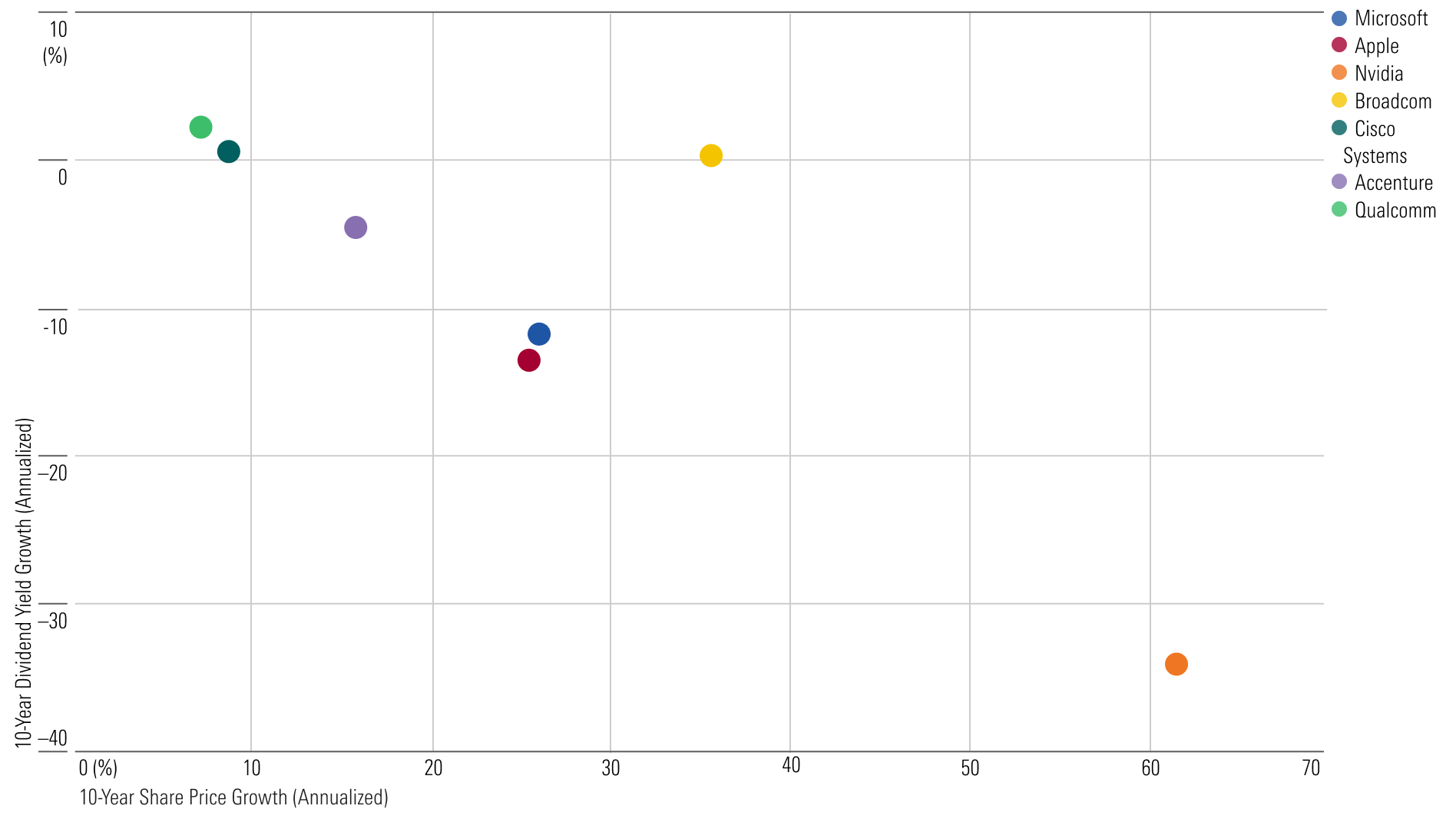

The average forward dividend yield within the Morningstar US Target Market Exposure Index is 1.14%. The stock with the highest yield is Cisco at 3.42%, while Nvidia has the lowest yield at just 0.02%. Additionally, while all stocks in the group have increased the amount of dividends paid each year over the past decade, only Qualcomm, Cisco, and Broadcom have increased their yields. Yields on Accenture, Microsoft, Apple, and Nvidia have fallen significantly. Yields are a function of stock price, so the rapid rise in stock prices and modest dividend increases caused the stock to decline over time. Nvidia is the most extreme example, with its yield decreasing by 34.09% on an annualized basis from 2013 to 2023, while its stock price increased by 61.89%.

Source: Morningstar Direct. Data as of May 9, 2024.

Source: Morningstar Direct. Data as of May 9, 2024.

Dividend growth and dividend income strategy

Dividend strategies typically fall into one of three categories: income, growth, or blend.

Dividend income strategies generally focus on high-yield companies, while dividend growth strategies focus on companies that “can significantly and consistently increase their dividends over time,” Quinlan said.

The Franklin Rising Dividends Fund, a dividend growth fund, holds 22% of its portfolio in tech stocks, with its top 10 holdings including Microsoft, Roper Technologies ROP, Accenture, Texas Instruments, and Analog Devices. is named. “These are all examples of companies that we like, with attractive growth in terms of their ability to grow their businesses and innovative new products that drive capital value over the long term,” Quinlan said. says. Furthermore, he believes that “dividends per share will continue to increase.” The T. Rowe Price Dividend Growth Fund also owns 22% in tech stocks, with Microsoft and Apple in the top two positions in its portfolio.

If you look at income strategies, tech stocks are not very widely held. The Morningstar Dividend Yield Focus Index, which tracks stocks with attractive dividend yields and strong financials, has an 8% weight in tech stocks. This is less than half of the dividend growth index. The average yield of stocks in the Dividend Yield Focus index is 3.98%, which is higher than the yield of a single tech stock in the Total Market Exposure index.

Key metrics for dividend payers at large technology companies

Microsoft MSFT

“Microsoft's capital deployment strategy is centered around reinvesting in the business, paying dividends, buying back stock and generally making small acquisitions,” said senior equity analyst Dan Romanoff. . “We expect the share count to continue to decline over time, and we expect dividends to generally increase in line with earnings.”

Read Romanoff's full story on Microsoft here.

Apple AAPL

Future Dividend Yield: 0.55% Annual Dividend: $1.00 Morningstar Rating: 3 Stars Capital Allocation Rating: Exemplary

“In addition to strong investments, Apple boasts a strong balance sheet, which it uses to reward shareholders,” said stock analyst William Kerwin. “Apple's cash generation is impressive and we like the company's goal of becoming net cash neutral, which should help it avoid the opportunity cost of holding large amounts of cash. We also like the company's dividend and share repurchase program, which regularly returns all of its free cash flow to shareholders.”

The rest of Kerwin's outlook on Apple can be found here.

Nvidia NVDA

Future Dividend Yield: 0.02% Annual Dividend: $0.16 Morningstar Rating: 3 Stars Capital Allocation Rating: Exemplary

“NVIDIA's financial health is excellent. As of January 2024, the company had $26 billion in cash and investments, compared with $9.7 billion in short-term and long-term debt,” said Brian, Equity Strategist.・Korero says. “NVIDIA's annual dividend of $0.16 is very reasonable relative to its financial health and prospects, and the company also returns excess cash to shareholders through stock repurchases.”

Colello has more on Nvidia stock here.

Alphabet GOOGL/GOOG

Future Dividend Yield: 0.47% Annual Dividend: $0.80 Morningstar Rating: 3 Stars Capital Allocation Rating: Exemplary

“Alphabet delivered strong results in the first quarter, driving margin expansion through accelerated revenue growth and restructuring efforts,” said Michael Hodel, director of equity research. “The company has also set a dividend of approximately $10 billion per year at an initial rate and authorized an additional $70 billion in share buybacks. Although growth is unlikely to be able to maintain this quarter's pace throughout the year, , Alphabet's results will exceed our expectations this year.”

Let's take a closer look at Hodel's outlook for Alphabet.

meta platform META

Future Dividend Yield: 0.42% Annual Dividend: $2.00 Morningstar Rating: 2 Stars Capital Allocation Rating: Exemplary

“We believe Meta is well-positioned with access to capital in an industry that requires continued investment to compete and maintain market leadership,” Hodel said. “Meta announced a quarterly dividend of $0.50 per share in the first quarter of 2024. The company will also use a portion of the cash for stock repurchases and will remain under the Federal Trade Commission's continued antitrust scrutiny.” It is likely that they will continue to be active on the acquisition front, although this is limited.”

Investors can read more about Hodel's thoughts on Metaplatform here.

Broadcom AVGO

Future Dividend Yield: 1.58% Annual Dividend: $21.00 Morningstar Rating: 2 Stars Capital Allocation Rating: Exemplary

“We expect Broadcom to focus on strong cash generation,” Kerwin said. “In the short term, we expect the company to focus on repaying the debt it incurred for the VMware acquisition. In the long term, we expect the company to focus on increasing its dividend and making further acquisitions.” has committed to adhere to its dividend policy (50% of the previous year's free cash flow) even after the acquisition is completed.

Kerwin discusses Broadcom stock in more detail here.

Salesforce CRM

Future Dividend Yield: 0.57% Annual Dividend: $1.60 Morningstar Rating: 3 Stars Capital Allocation Rating: Standard

“Salesforce dramatically changed its capital allocation strategy starting in August 2022 when it began a formal stock repurchase program, with $18 billion in repurchase authorization remaining as of February 2024,” Romanoff said. . “In February 2024, the company paid a quarterly dividend. We expect a balanced approach between share buybacks, dividends, and internal investments for product innovation.”

Read Romanoff's full story on Salesforce here.

Cisco Systems CSCO

Future Dividend Yield: 3.33% Annual Dividend: $1.60 Morningstar Rating: 3 Stars Capital Allocation Rating: Exemplary

“In our view, Cisco's shareholder return policy is excellent,” Kerwin said. “The company has a strong balance sheet and generates significant cash flow. More than half of this cash flow is allocated to dividends and share buybacks, which we view favorably. Cisco's Dividend The yield and total shareholder return, including share buybacks, should be attractive to long-term investors.”

Let's take a closer look at Kerwin's outlook for Cisco.

Accenture ACN

Future Dividend Yield: 1.65% Annual Dividend: $5.16 Morningstar Rating: 3 Stars Capital Allocation Rating: Exemplary

“While we believe Accenture's shareholder distribution is mixed as dividends and share buybacks do not divert R&D efforts, Accenture's share price is significantly overvalued,” said equity analyst Julie Bhusal Sharma. We carry out share buybacks at times when we believe that the “The company has consistently increased its dividend every year, but over the past 10 years the dividend has fluctuated between 35% and 45%. Share buybacks are a pillar of Accenture, and the company have each repurchased between $1.5 billion and $2 billion in the past 10 years.

Investors can find out more about Mr. Sharma's views on Accenture here.

Qualcomm QCOM

Future Dividend Yield: 1.88% Annual Dividend: $3.40 Morningstar Rating: 2 Stars Capital Allocation Rating: Standard

“The company intends to distribute a significant amount of its free cash flow, so we believe it has demonstrated a sound strategy to return cash to shareholders,” Colello said. “The company has consistently repurchased its own stock in recent years. Qualcomm also pays a steady quarterly dividend.”

The rest of Colello's outlook for Qualcomm can be found here.