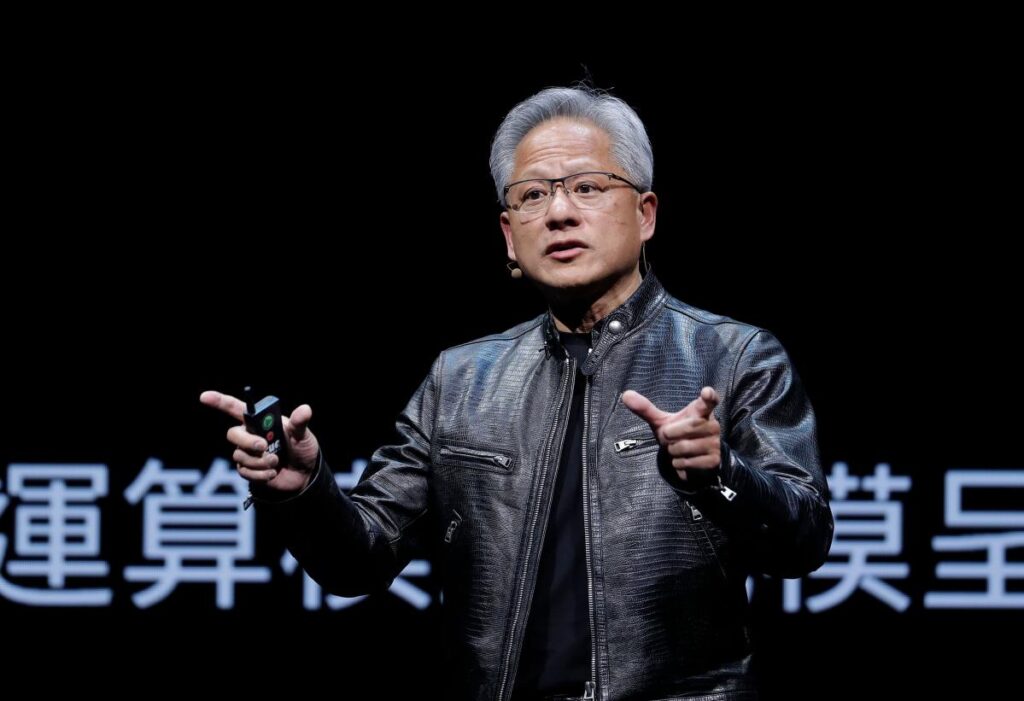

Nvidia CEO Jensen Huang: Nvidia is up 175% this year. (Qiang Yingying, The Associated Press)

Nvidia (NVDA)

Nvidia's strong rally continued overnight, rising 3.5% to overtake Microsoft (MSFT) as the world's most valuable stock. It was up 0.6% in premarket trading on Wednesday.

The shares rose to more than $135 (106 pounds) a share, giving the chipmaker a market capitalization of more than $3.33 trillion.Microsoft, which fell 0.4 percent on Tuesday, has a market capitalization of nearly $3.32 trillion.

This comes just two weeks after Nvidia took the number two spot from Apple (AAPL).

Nvidia shares are up more than 215% in the past 12 months and 3,400% in the past five years, thanks to an explosion of interest in generative AI since OpenAI unveiled its ChatGPT software in late 2022.

Nvidia shares have risen 175% so far this year, while Microsoft shares are expected to rise just under 19% in 2024.

Nvidia surpassed $1 trillion in market cap for the first time on June 13, 2023. The company's rise from $1 trillion to $3 trillion in market cap was the fastest on record.

Nvidia completed a 10-for-1 stock split on June 10.

Berkeley (BKG.L)

Housebuilder Berkeley posted a loss this morning despite raising its profit forecast for the current period by 5% to £525m.

The company's pre-tax profit for the year to 30 April fell to £557 million from £604 million last year, making it the biggest faller among the FTSE 100 index companies.

The company announced it would launch a rental house building division and re-enter the private rental market for the first time in 10 years to address a “serious property shortage” in London and the surrounding areas.

Berkeley, which built 3,500 homes for private sale last year, is launching a rented house building business and aims to build 4,000 homes in London and the South East over the next decade.

The company plans to develop properties on 17 brownfield sites and launch a dedicated online platform to manage them.

“A number of well-intentioned regulatory and policy changes have been enacted in recent years, creating an increasingly uncertain operating environment,” Barclay said.

The story continues

“This has resulted in a significant reduction in private affordable housebuilding activity, particularly affecting small and medium-sized developers and housing associations.”

“The significant reduction in housing supply has been recognised by policymakers at all levels and has sparked a renewed focus on addressing barriers within the regulatory and planning system.”

Read more: UK inflation falls to Bank of England's 2% target

Games Workshop (GAW.L)

Warhammer maker Games Workshop saw its shares rise 8 percent in London after it said it expected its full-year pre-tax profits to rise to at least 200 million pounds, up from 171 million pounds a year earlier.

The maker of miniature figures for tabletop battle games said its full-year profit rose at least 17 percent after an acceleration in the second half of its fiscal year.

Core revenue rose 10% to more than £490 million in the 53 weeks to June 2, while pre-tax profits are now expected to be “in excess of £200 million”, compared with £171 million a year ago.

Pre-tax profits for the first half of the year rose 14% to £95.2m.

Profit estimates include a deduction of £18 million for the employee profit sharing scheme, which is paid equally in cash to each employee, while dividends of £138 million were paid and declared for the year, amounting to 415 pence per share.

Just Eat (JET.L)

Just Eat shares rose more than 2% on Wednesday after reports that the company had partnered with Amazon (AMZN) in Germany, Austria and Spain.

Europe's largest food delivery company said the move would mean free delivery for food orders over 15 euros ($16.13).

The deal marks the company's first partnership with Amazon in Europe, but there are no financial terms to the partnership, which is “mutually beneficial” for both companies.

The first contract between the two companies was signed in mid-2022.

Amazon last month announced that U.S. customers could order directly from Just Eat-owned Grubhub on its shopping app and website, and expanded a deal to give Prime members free Grubhub+ memberships.

“Offering Prime members free delivery from restaurants listed on Just Eat Takeaway.com is another way we help our members save money every day,” said Jamil Ghani, vice president of Amazon Prime.

“This benefit continues to make Prime membership even more valuable, and now is the perfect time to enjoy the convenience, savings, entertainment and deliciousness that membership benefits have to offer.”

WATCH: What is a SPAC?

Download the Yahoo Finance app, available for Apple and Android.