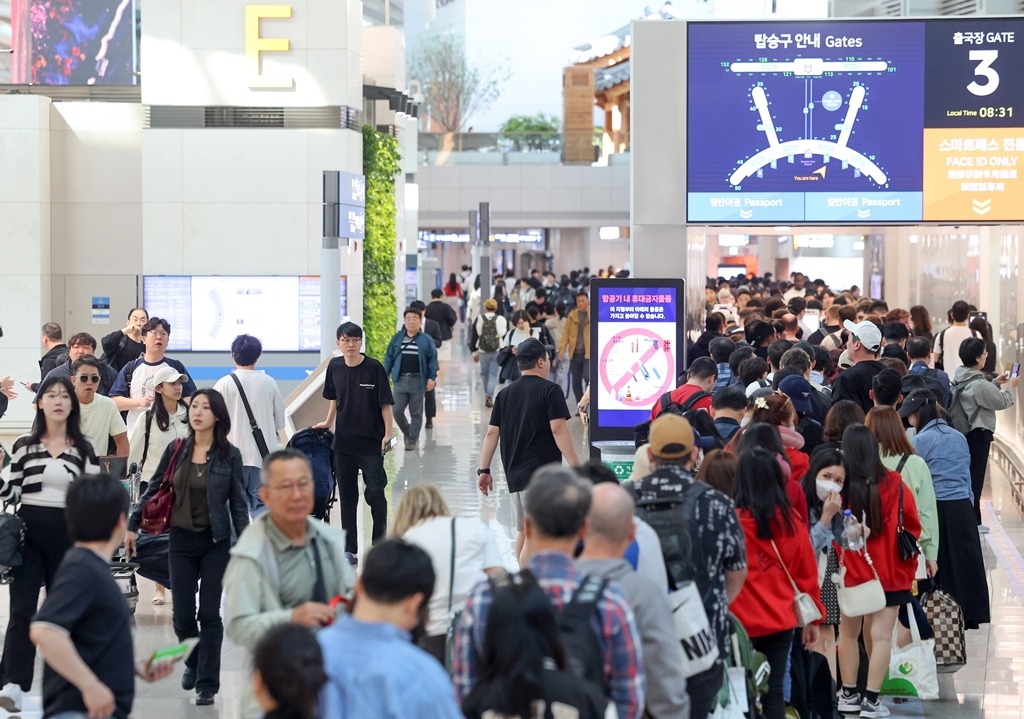

The departure terminal at Incheon International Airport, South Korea's main gateway, on May 3, 2024 (Photo by Choi Hyuk)

The rise in overseas travel and cross-border shopping has intensified competition in Korea's travel money card market as credit card issuers seek to attract new customers with such services.

Data released Monday by the Korea Credit Finance Association showed that overseas payments by individual customers of South Korea's eight credit card issuers rose 28% year-on-year to 7.5 trillion won ($5.4 billion) in January-May 2024. Of that, payments made by credit cards accounted for 5.6 trillion won, while payments made by debit and check cards accounted for 1.9 trillion won.

Hana Card, South Korea's seventh-largest credit card issuer by assets, led the way with a 19.8% market share during the period, as customers paid 1.5 trillion won in overseas payments through the company's credit, debit and check cards.

From January to May 2024, the company accounted for 52% of the overseas check card payment market.

Korea's first travel money card issuer, HANA

The wholly owned subsidiary of Hana Financial Group, whose baking division is South Korea's largest foreign exchange market player, launched the Travelogue Check Card in June 2022.

This is the first travel money card in Japan that allows users to save foreign currency for overseas travel, and users can use the card to withdraw foreign currency from ATMs in other countries and to shop at local stores.

“When the Travel Log Card was first introduced, it didn't get much attention due to the impact of COVID-19,” a Hana Card official said, “but as the pandemic became endemic, the card quickly spread through various blogs.”

Korea's first travel money card, the Hana Travelogue Check Card (file photo)

Big companies join the race

Other credit card issuers rushed to announce similar services, offering perks such as free currency exchange, waived fees and free airport lounge access in an effort to attract new customers.

Shinhan Card, Korea's largest credit card issuer by assets, introduced the SOL Travel Check Card in February. Shinhan Card became the second-largest company in the overseas payment market with a 19.2% share from January to May.

KB Kookmin Card launched the KB Kookmin Travelers Cheque Card, Samsung Card unveiled the iD Global Card in April, and Woori Card introduced the Wibee Travel Cheque Card in June.

The credit card divisions of major financial holding companies such as KB Financial Group, Shinhan Financial Group and Woori Financial Group have linked their travel money cards to foreign currency accounts at their affiliated banks.

For example, customers who want to use the SOL Travel Check Card need a foreign currency account with Shinhan Bank.

“Travel money cards are important for customer acquisition not only for card issuers but also for banks,” said an industry source. “The product is very effective in locking in existing customers.”

Author: Seo Hyeon-kyo

Email: seogyo@hakyung.com

This article was edited by Jeong Jeongwoo.